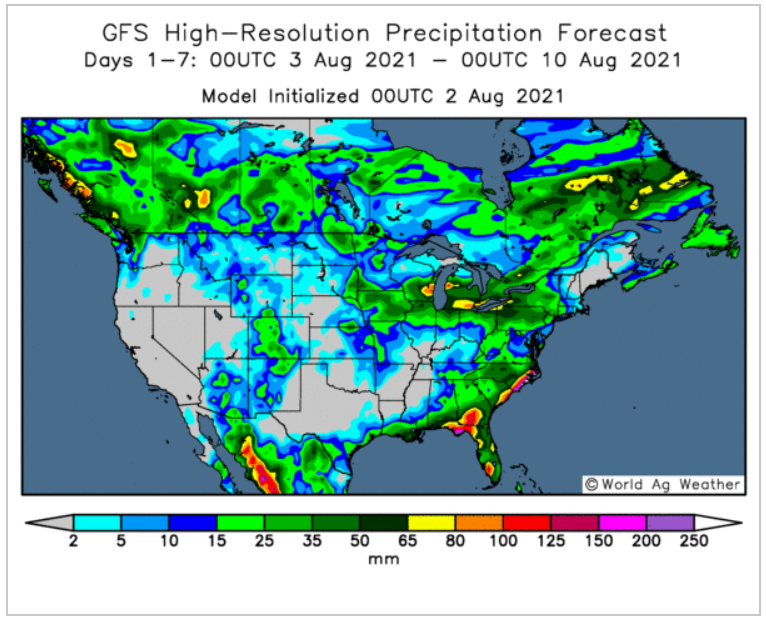

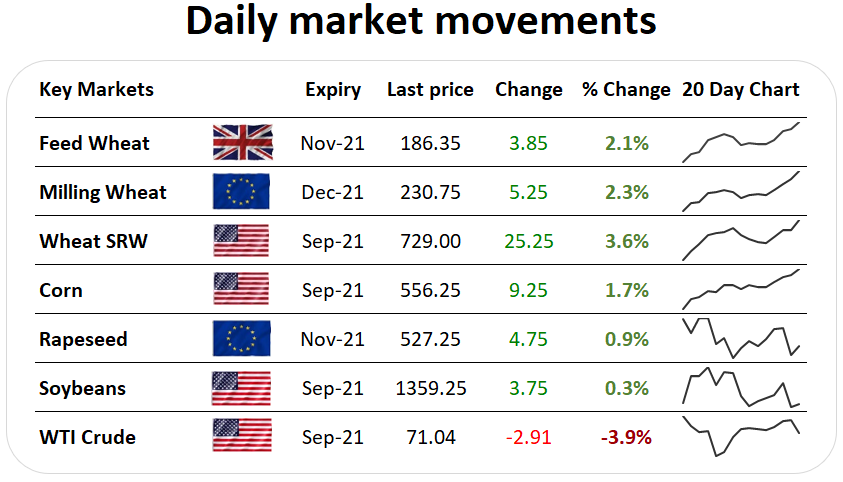

| Wheat markets have found support as US spring wheat continues to suffer, alongside cuts to Russian wheat production outlooks. Little rainfall has fallen over the last week in key US spring wheat states, and crop condition scores are likely to continue to worsen. This evening’s USDA crop progress report is likely to highlight across-the-board declines in crop condition scores. Russian wheat production estimates have been further trimmed following what have continued to be poor yields and cuts to the forecast winter wheat area. IKAR reduced their production forecast to 78.5Mt down from 81.5Mt. Managed Money moved to hold an overall near equal number of long and short contracts last week. In corn, while funds marginally reduced the number of long positions, cutting the number of short contracts held to a further degree and the overall net position moved to a month high net bullish position. Positions in soy were mostly unchanged. What does this mean? August will be pivotal for US corn production and rainfall will be key. In Russia and as harvest progresses, with a large focus on poor initial yields, there will be a greater focus on spring wheat. |