| The start of the week coincided with the first of this season’s USDA Crop Progress report, released at 4pm US Eastern Time – UK 9pm.

Of note in the first USDA crop progress report have been the Winter Wheat Condition scores.

US winter wheat has been rated at: 18% Very Poor, 18% Poor, 35% Fair, 27% Good and 3% Excellent ( 30% G&E ). In the last crop progress report before winter, the USDA had reported that winter wheat was rated at 8% Very Poor, 15% Poor, 33% Fair, 38% Good and 6% Excellent. The on-going drought conditions continue to raise concerns for US winter wheat, with the proportion of wheat rated good and excellent having deteriorated.

Read the full report here

In addition to today’s first look at the USDA’s crop progress reports, Friday will have the USDA release the April WASDE.

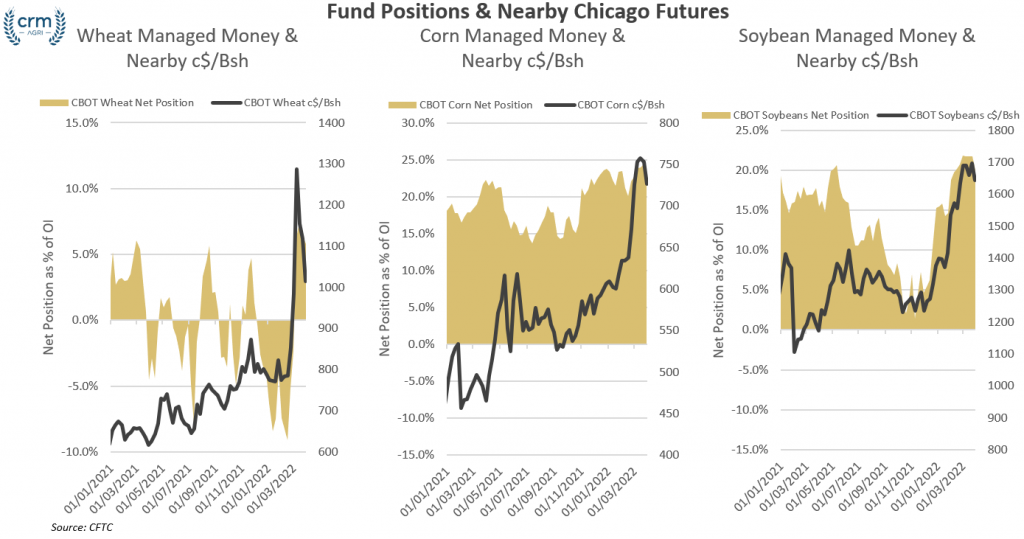

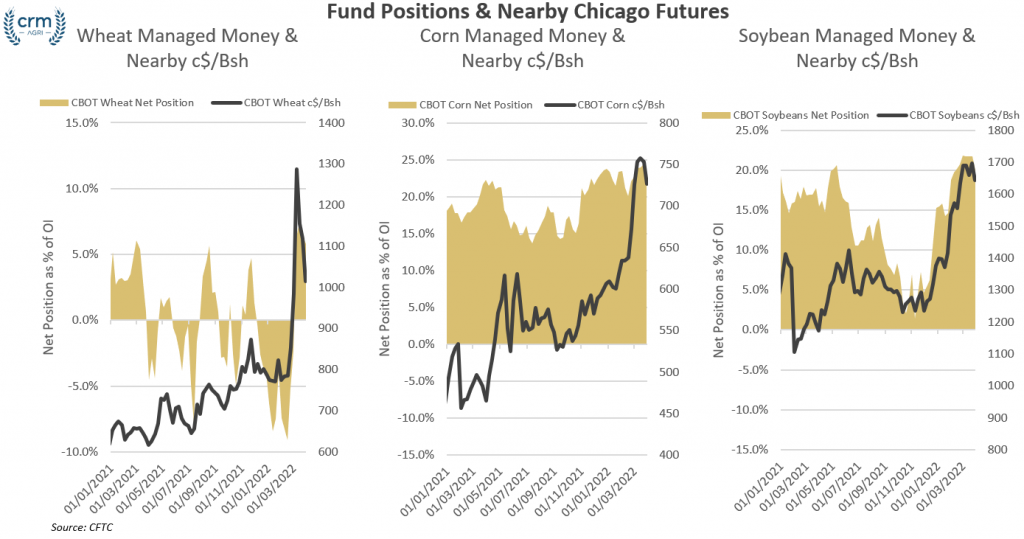

At the start of another WASDE week, and ongoing war in Ukraine, it is also worth looking at Managed Money positions held last week on Chicago markets.

Wheat: As old crop markets have been under pressure, Managed Money positions in Chicago wheat have trimmed their bullish positions, marginally reducing the number of long positions held, while also increasing the number of short positions held.

Corn: Managed Money positions in corn were also trimmed marginally, trimming the long position held, while increasing the short positions held to a four week high, however, last week’s planting report ( read more on GrainTab ), and flash export sales have been far from bearish.

Starting the week, and China has been back shopping for US corn, making an impressive 1Mt of corn purchases, split 676Kt for old crop corn and 408Kt for 2022/23. The question now with the ongoing uncertainty for Ukraine, is China going to be a regular US corn purchaser once again?

Soy: Like with grains, managed money slightly trimmed the number of long positions held in Chicago soybeans, down to 160.5k long contracts, down from 171k the week before, however still remain in a long overall positions. |