Editorial updated: 7/10/2021

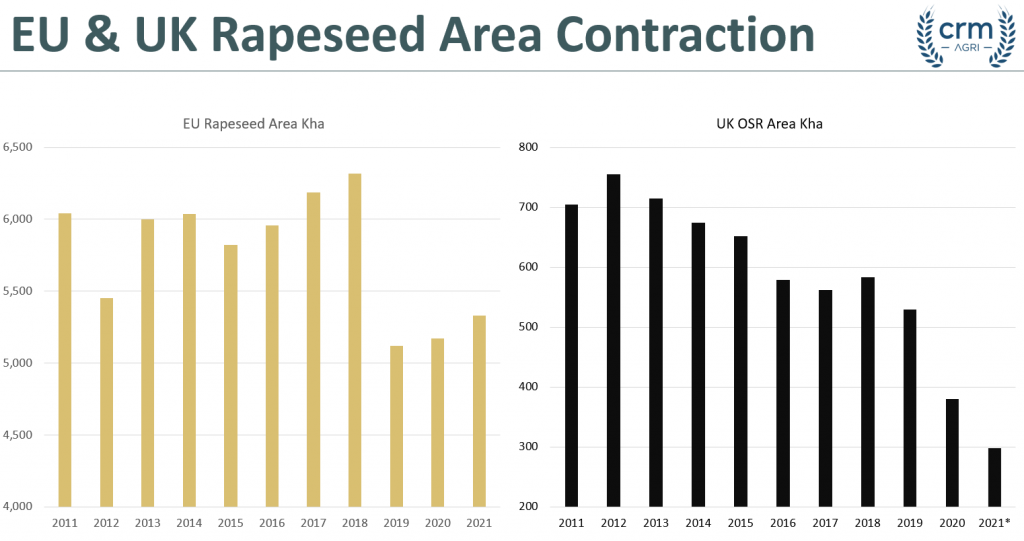

| Surging canola prices, or rapeseed as it’s known in Europe, have been long overdue following four consecutive years of stock depletion in the EU. European farmers have been reluctant growers of rapeseed in recent seasons with a ban on Neonicotinoids and Flea Beetle damage making it a risky crop to grow. Additionally, in the UK growers have been under the same pressure, with the area having fallen by over 50% in the last 6 seasons, further adding to what has been a continual decline in European rapeseed availability. |

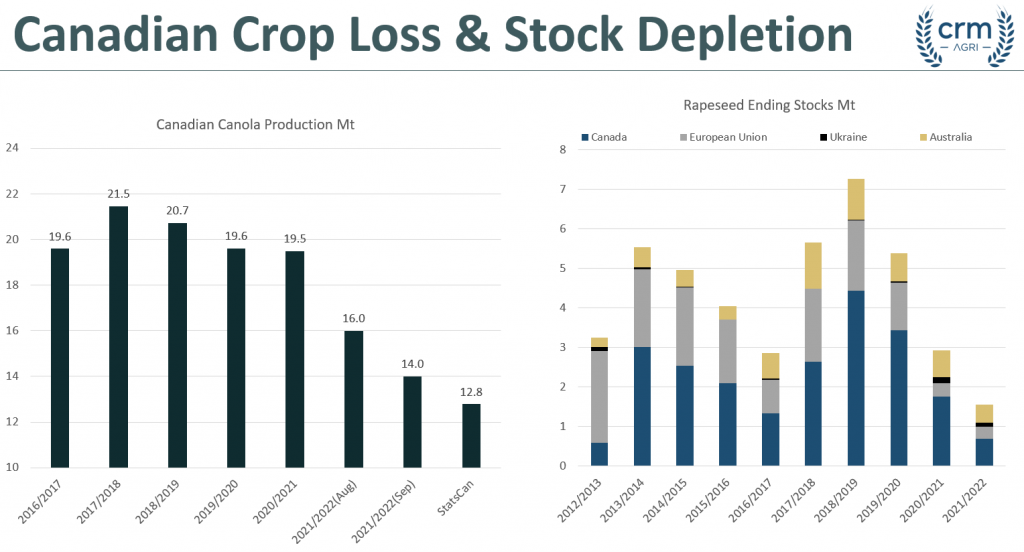

| However, the catalyst for the price rise recorded over the last 6 months has predominantly been Canadian production, where canola stocks have fallen from 4.4MT in 2018/19 to a forecast 691KT by the end of 2021/22 as a result of drought-induced widespread crop loss. On top of the tight rapeseed situation, we have seen a sharp depletion in soybean stocks last season, a competing source of feedstock for biodiesel, and with tight soybean supplies, vegetable oil markets have soared. Labour shortages and weather issues in key palm-producing regions of Malaysia and Indonesia have also contributed to the surge in palm oil prices, with demand fuelled by a global economic recovery and increasing diesel demand further driving the oilseeds rally and underpinning values. |

| Yet while markets keep climbing, prices are showing signs of being overvalued, as markets enter key producing months for palm, the US soy harvest, and what looks set to be a strong Australian canola export season. However, it is unlikely we will see a return to more normal pricing levels until there is much more confidence in improved supplies throughout the oilseeds complex and an easing of global vegetable oil markets. With a greater oil proportion in rapeseed than in soybeans, this bullish global vegetable oil market is being felt to a far greater extent than in the larger soybean market. While physical supplies remain tight, the larger oil content of canola / rapeseed when compared to soybeans is more exposed to a price drop should vegetable oil prices fall. From a meal perspective, crushing has been incentivised and meal prices have been under pressure due to higher veg oil prices. New crop Chicago soymeal has now fallen to 12-month lows, which has been preventing rapeseed meal from further price gains. With the extremely low global supply of rapeseed, rapemeal prices are likely to maintain a strong premium to soymeal. |

| Looking ahead, and with spot prices now over €650/t, our expectation is that plantings could increase by up to 10-20% on last season, not only in the EU but also in the UK as the rewards start to outweigh the risks. At this stage and we have to assume that Canadian producers won’t be put off from growing Canola again for next season, and overall the long-term outlook is for easing supplies but for the remainder of this season and sourcing rapeseed and meal will remain a challenge. Read more opinions in our weekly oilseeds report |

Categories: Blog