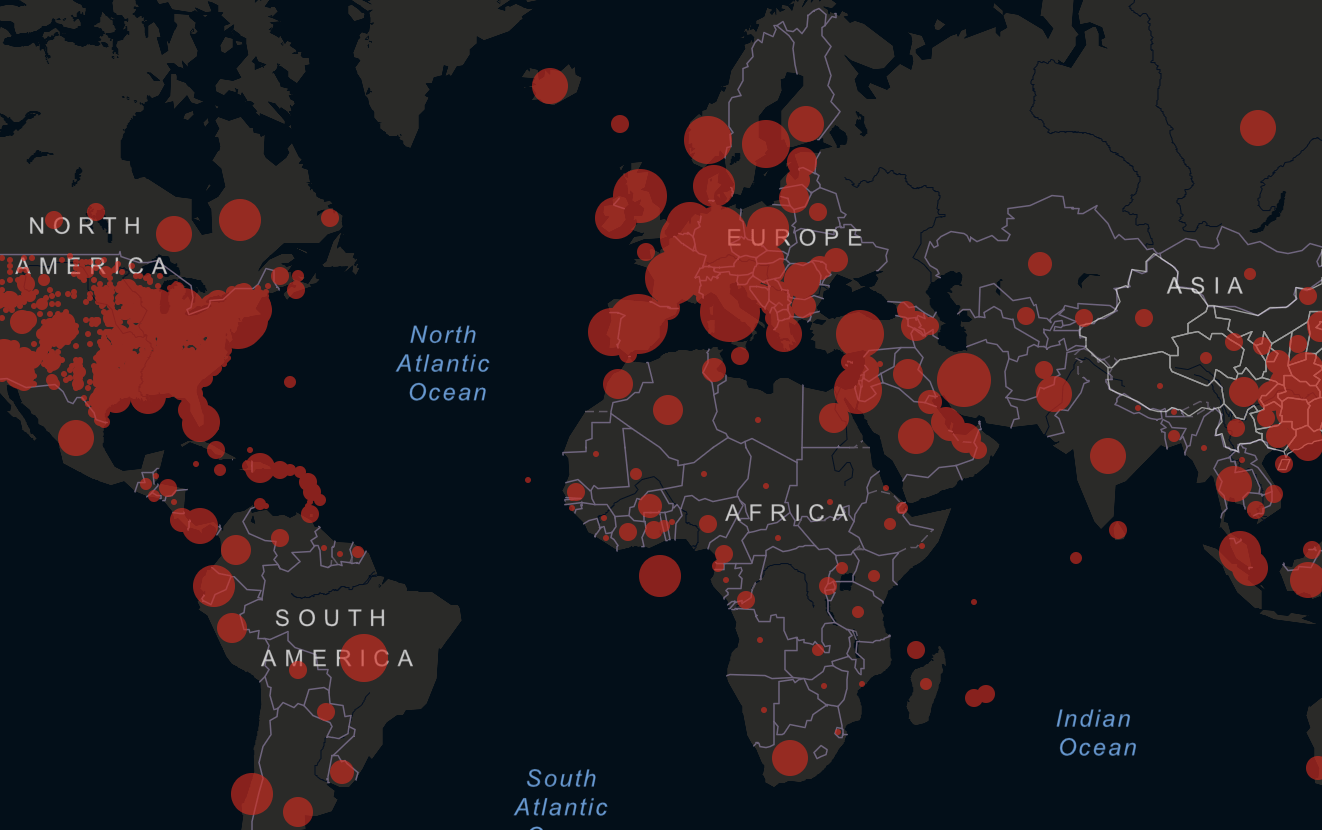

Even if Europe is apparently no longer the epicentre of the COVID-19 outbreak, logistical disruptions, panic buying and currency swings are still ongoing across the bloc with unprecedented measures taken at a state level rather than at a unified EU level. Coupled with prevailing dryness across the Black Sea and a 7MMT grain export quota in Russia from April to June 2020, wheat saw an extreme period of volatility in March. The May-20 Euronext wheat futures contract traded within a 23.75€/T range, falling to a 7-month low on Mar 12th before soaring toward its long term resistance level at 198.00€/T. On the physical market, Russian wheat prices have reached their highest level on record (in RUB/T terms) due to a tumbling rouble driven by collapsing energy prices, whilst seeing strong demand from domestic millers. The 3-month grain export quota is in line with market expectations, but it signals that if crop conditions for the 2020 harvest were to deteriorate further, the Kremlin could easily extend this political decision into the next marketing campaign. Similar stories are reported in Ukraine and Kazakhstan whilst the EU wheat crop is set to drop by more than 10MMT on last year.

Even if the impact of the COVID-19 outbreak on demand is unknown, the tightening wheat stocks in the Black Sea and in Europe coupled with the period of ‘weather market’ ahead of us set the scene for a very turbulent 2020/21 marketing season.