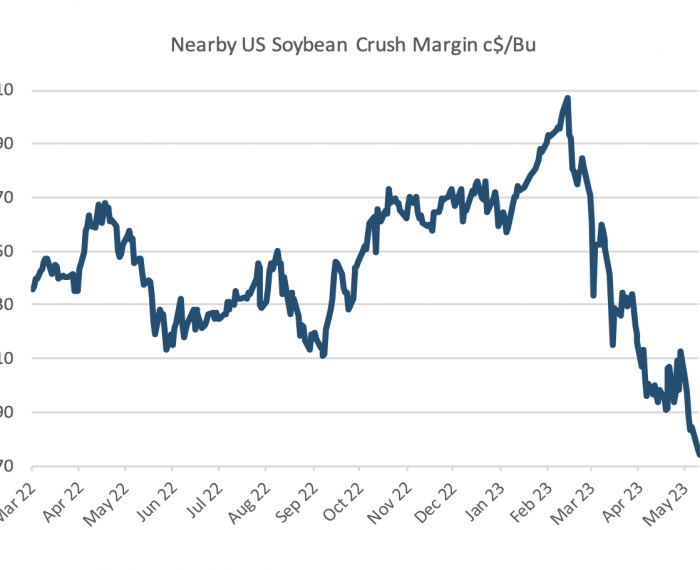

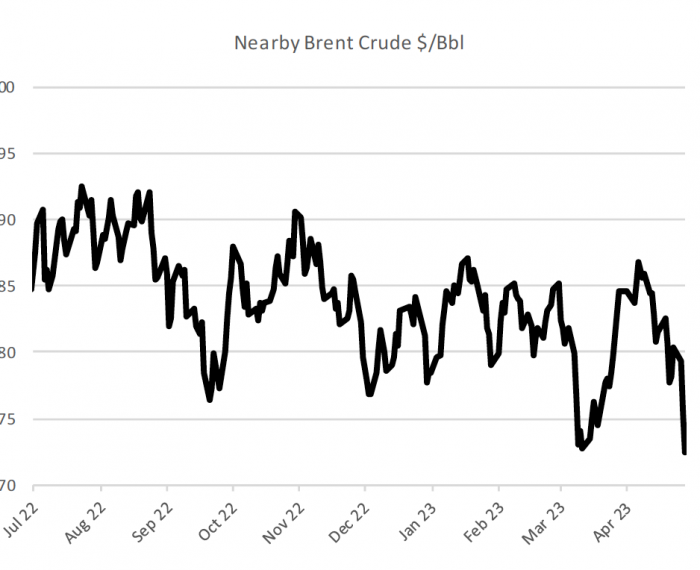

Soyoil has, like other vegetable oils, buckled under the fresh selldown in the crude oil market, encouraged by ideas of steady production at a time when economic worries are undermining consumption. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

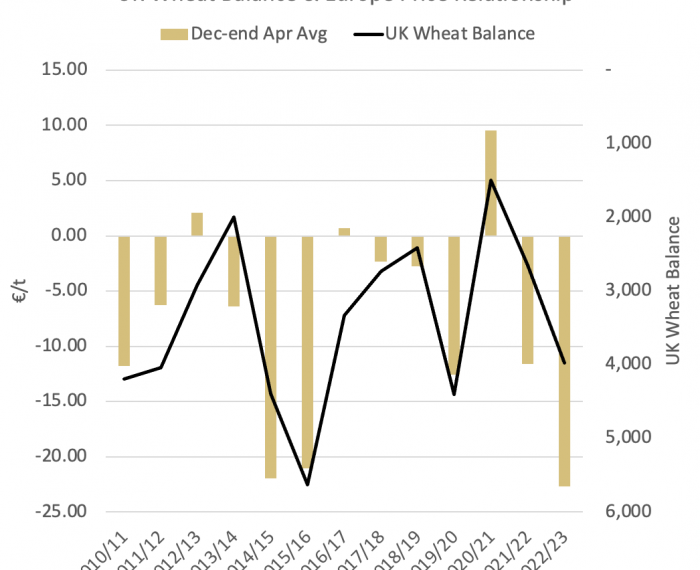

Understanding the relationship between UK and European wheat grain prices. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

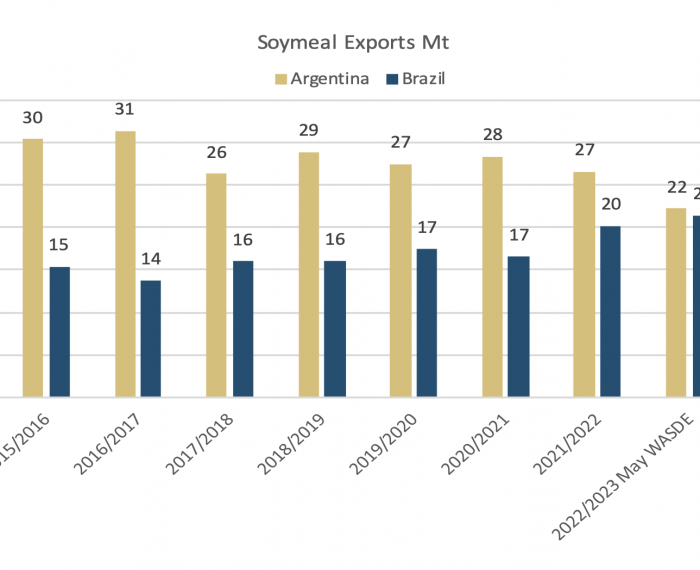

While the Argentine crush is lagging, Brazilian processors have filled a little of the void in international supplies by meeting nearly 1.6Mt oil meal exports for the first three weeks of May. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

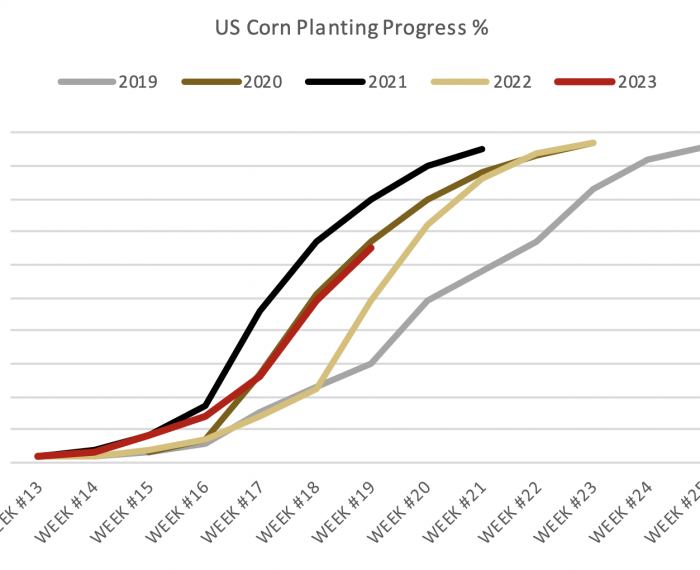

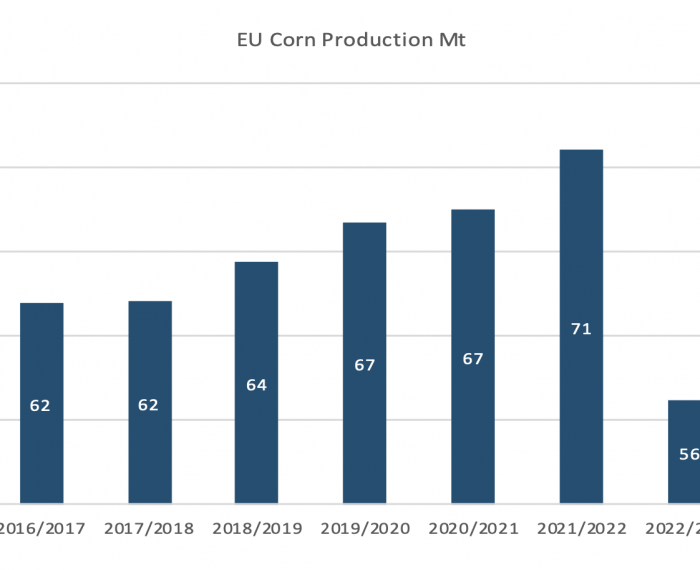

US corn plantings have continued apace, offering clear passage thus far to expectations of a record harvest-23. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

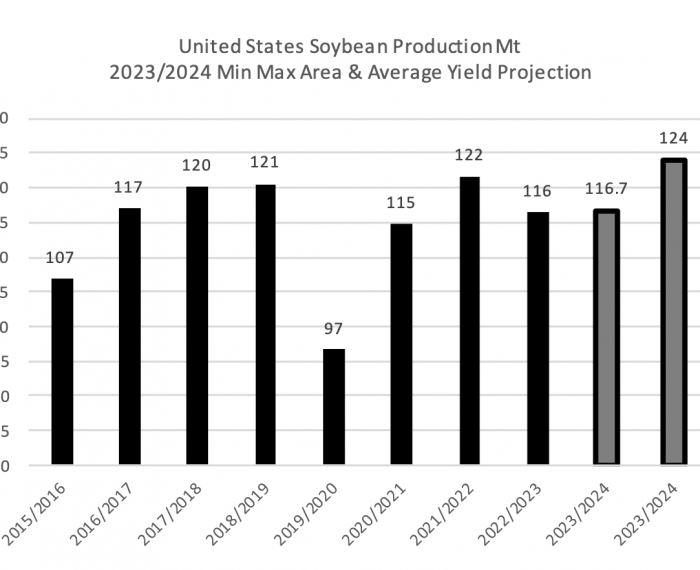

From the pointers we have so far, the Wasde looks poised to signal a downward trend for prices, as the US leads expansion in inventories among major soybean exporting countries. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

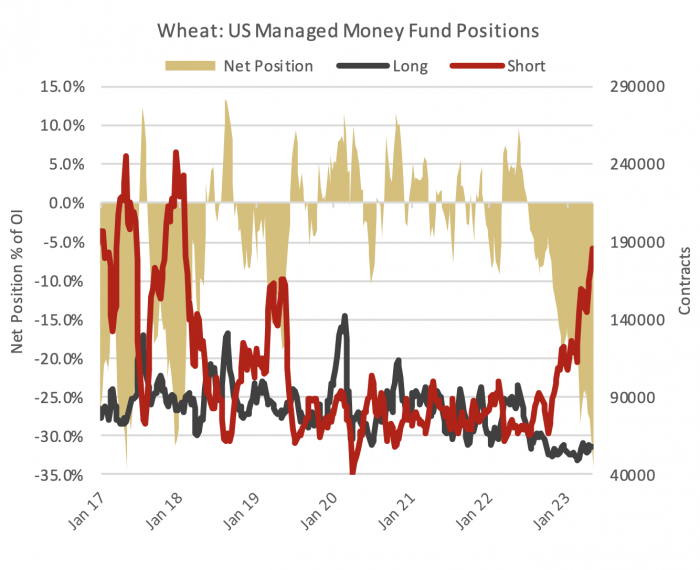

Wheat speculators gross short holdings have, for the first time on data going back to 2006, reached a level equivalent to 50% of total open interest. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

May’s recovery in vegetable oil prices, so far, contrasts with continued declines in crude oil, an important influence on prices of vegetable oils, which are used largely in making biodiesel. It also runs against the trend of 2023 which has seen prices of the likes of rapeseed oil and soyoil underperform those of Brent crude. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

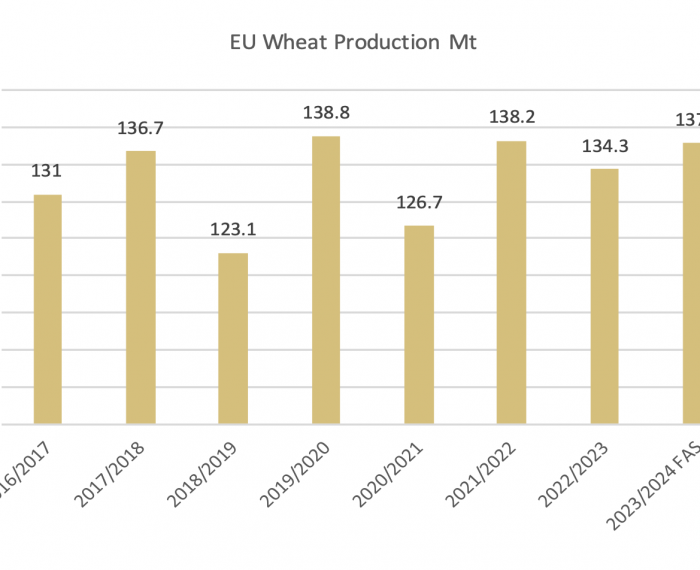

In Europe, the European Commission’s Mars bureau forecast this year’s EU soft wheat yield at an above-average 6t/hectare, while in the US, rains in the southern Plains have boosted expectations of a recovery in the drought- pressed hard red winter wheat crop. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

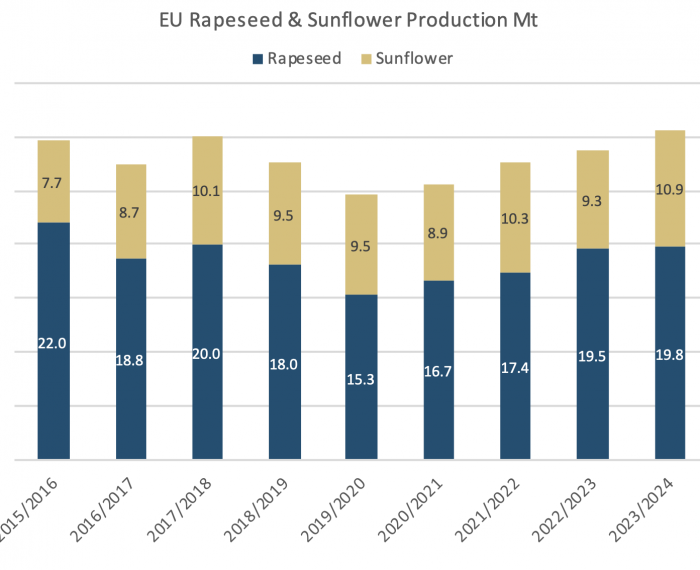

The planted area for sunflowers is due to see a 10% increase above 5-year average and reach 4.8Mha, on account of the temporary derogation from the obligation to allocate a part of the arable land to non-productive areas and a possible switch from corn in drought affected regions. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

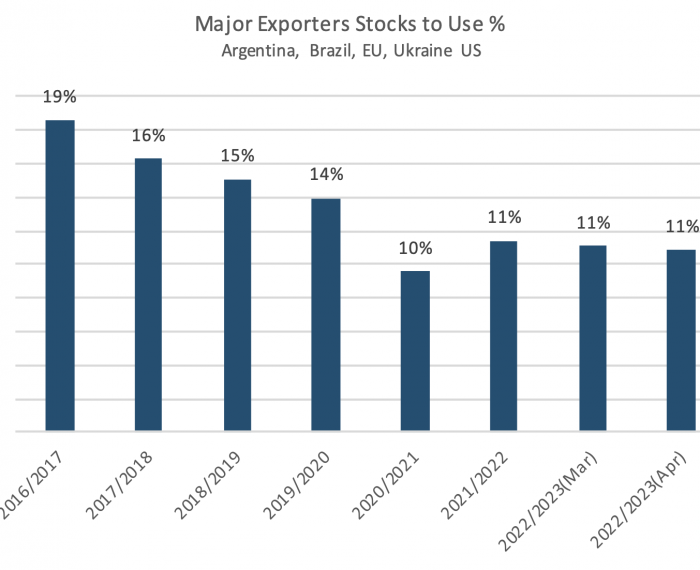

Grain markets have sagged, as discourse surrounding Ukraine’s exports subsided and wet southern Plains forecasts eroded concerns for the US hard red winter wheat crop. However, factors remain in place which could yet provoke price recovery and for now, prices remain underpinned by tight exporter stocks and new crop uncertainty. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

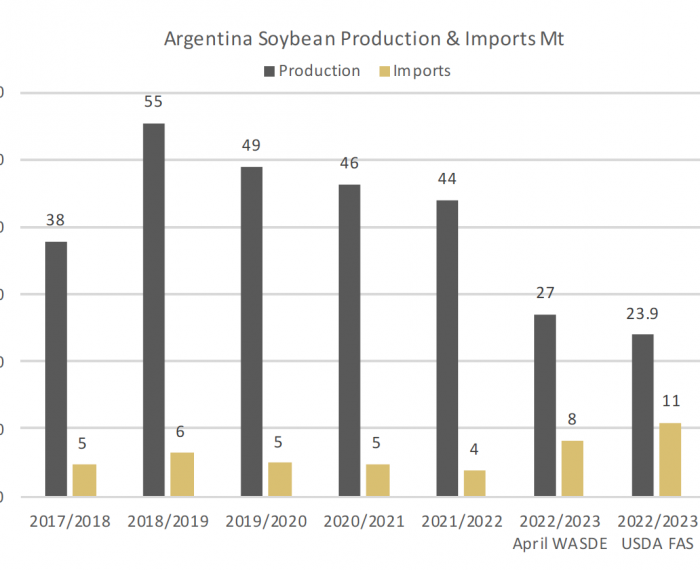

With deeper cuts to production, Argentina will have to import a record 11Mt of soybeans to supply its crushing sector. In recent years Argentina has crushed about 40Mt per year and has a theoretical annual capacity greater than 65Mt, supplying close to half of the EU’s meal import requirement. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The renewal in mid-March of the Black Sea grain corridor, for just 60 days, is set to expire in just four weeks, bringing the extension of the agreement back into focus. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe