Signup to this report hereWheat prices edged higher in Chicago and Paris after the USDA,…

Analysis of the USDA’s October WASDE report. Corn Soybeans Wheat Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Soybean futures headed for their first close below $10.00/Bu in nearly four years, dragging rapeseed lower too, after the USDA hiked further…

Wheat futures renewed their decline as the USDA in its monthly Wasde crop report lifted its forecast for world stocks of…

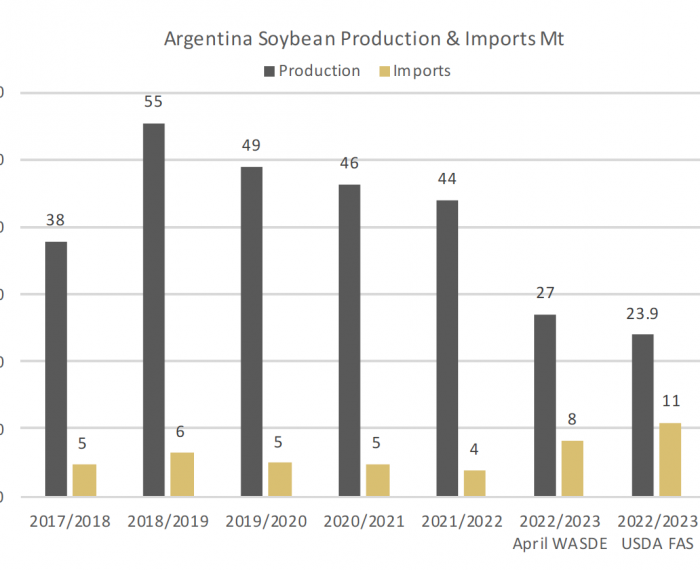

With deeper cuts to production, Argentina will have to import a record 11Mt of soybeans to supply its crushing sector. In recent years Argentina has crushed about 40Mt per year and has a theoretical annual capacity greater than 65Mt, supplying close to half of the EU’s meal import requirement. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

NDVI scores for Ukraine have also added confidence for new crop harvests, with scores particularly in western areas, where the majority of rapeseed is planted, recording above-average scores. However, while greater confidence in rapeseed production in Ukraine is now entering forecasts for supply in 2023/24, production is still set to contract year on year. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

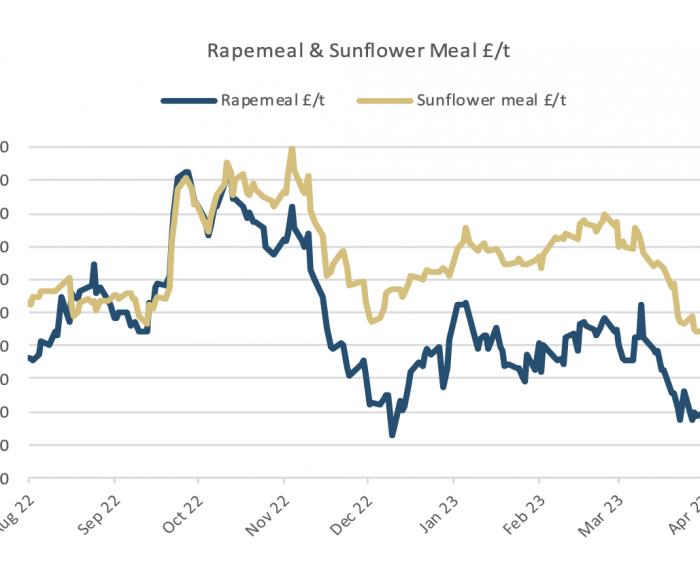

Rapeseed: Rapeseed prices have staged a recovery, after last week falling to their lowest since July 2021.Rapeseed’s price upturn tallied with revivals in many markets, as concerns receded over the bank sector tremors stemming from Silicon Valley Bank’s collapse, and UBS’s takeover of Credit Suisse. Signally, crude oil futures, an important influence on prices of crops such as rapeseed used largely in making biofuels, bounced from their lowest levels since late 2021 as worries over economic fallout faded. Soybeans: Having fallen back down to October lows earlier this month, May-23 US soybean futures have been recording a partial recovery. The bounce in crude oil is providing a floor to oilseed markets, and despite the arrival of the Brazilian soybean harvest, bearish downward pressure is reducing. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Rapeseed: While the pace of EU imports has slowed this month, they remain on course to set a record high above 6.5Mt for the full 2022-23… Soybeans: After what has been a sustained period of support for soybean prices, which remained buoyant while grains came under pressure… Oil & Meal: Vegetable oil values have continued to come under pressure, undermined by the broader economic pressures… Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Current market overview and short term outlook for Oilseeds. – Rapeseed – Sunflower – Soybeans – Weather Alerts Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe