As harvest gathers pace and following the release of the July USDA report, this short video for clients covers: – Global economic drivers – USDA data – Global supply & demand – Oilseeds & veg oils Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

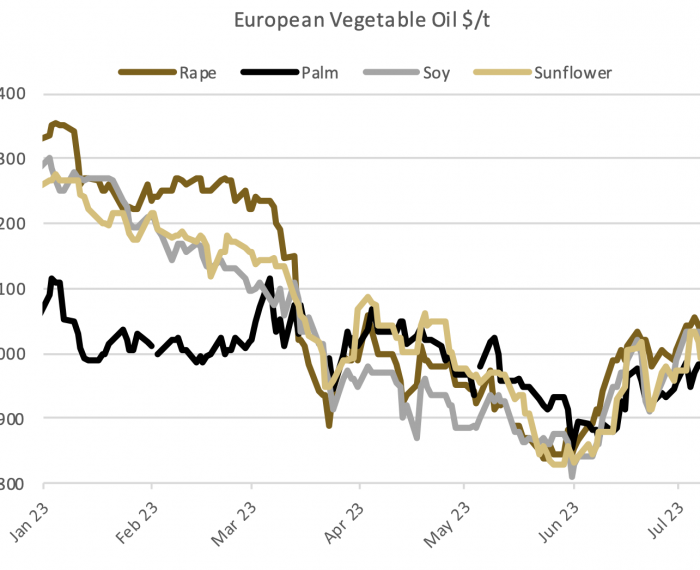

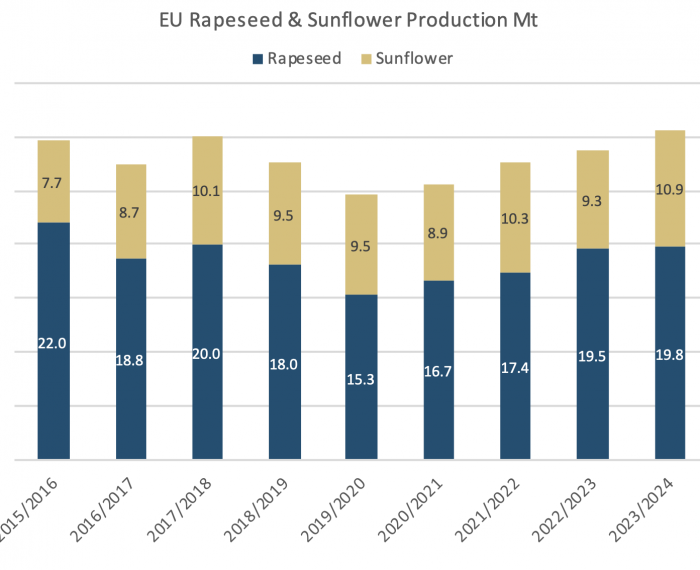

The strength in vegetable oil prices, encouraged most lately by Malaysia’s lower-than-thought palm oil stocks data, (see below) has been instrumental in supporting rapeseed prices. Rapeseed, with its relatively high oil content versus meal, is particularly influenced by vegoil market moves. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

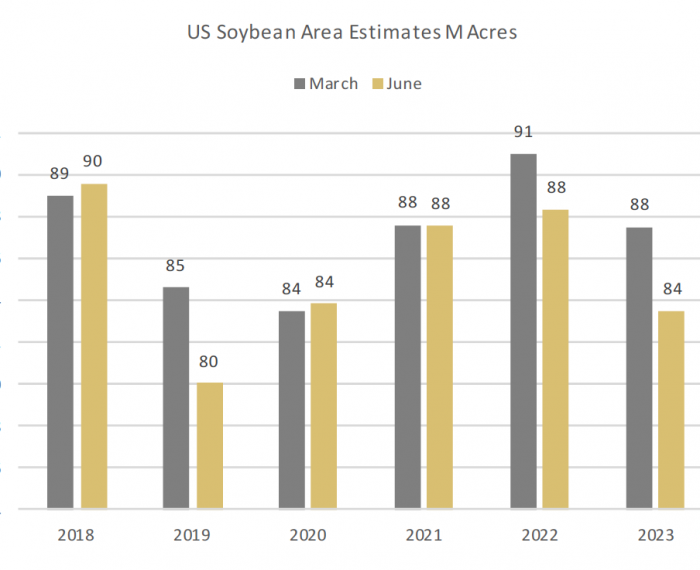

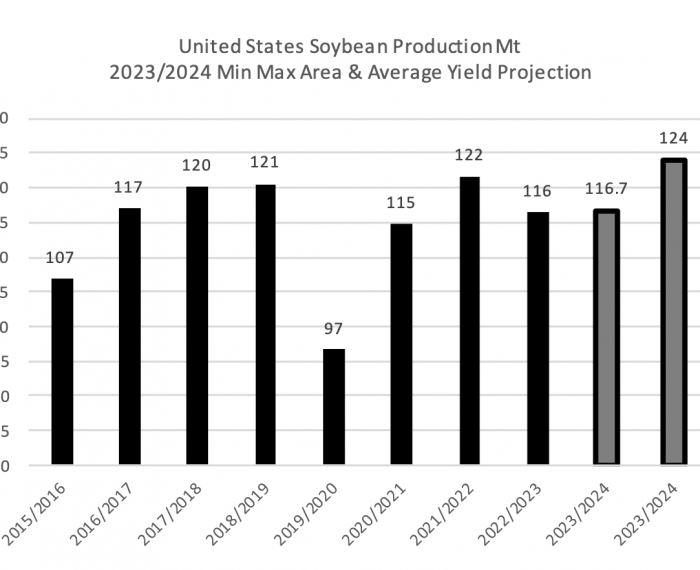

The ratio between November-23 soybean futures and December-23 corn has now risen above 2.7, enhancing soy’s relative appeal, as South American farmers plan their next sowings campaign as starts in two months’ time. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

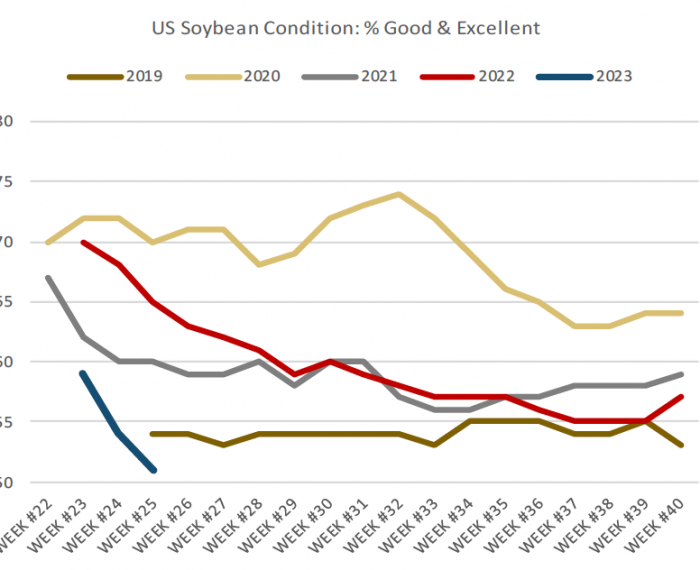

For soybeans, 51% of the crop rated “good” or “excellent” as of Sunday was the lowest rating for the time of year on data going back to 1995. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

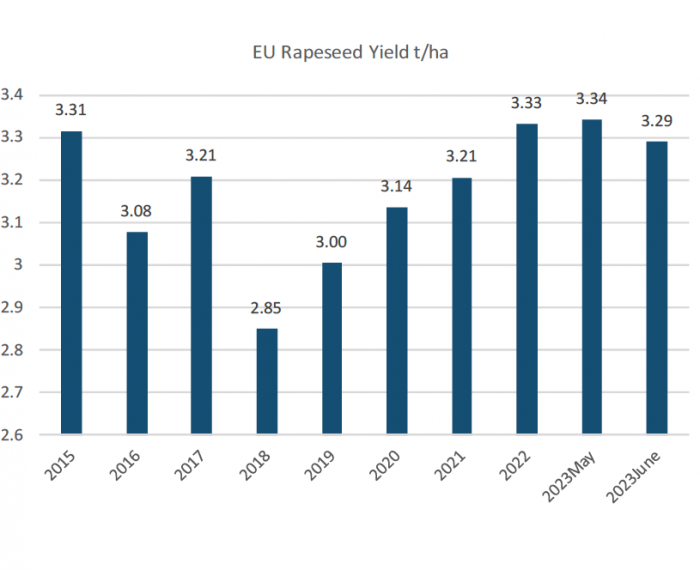

Europe’s dryness has ended the run of upgrades to EU rapeseed harvest expectations, with yield estimates from the likes of the EU Commission’s Mars bureau now being trimmed, if remaining above five-year average levels. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

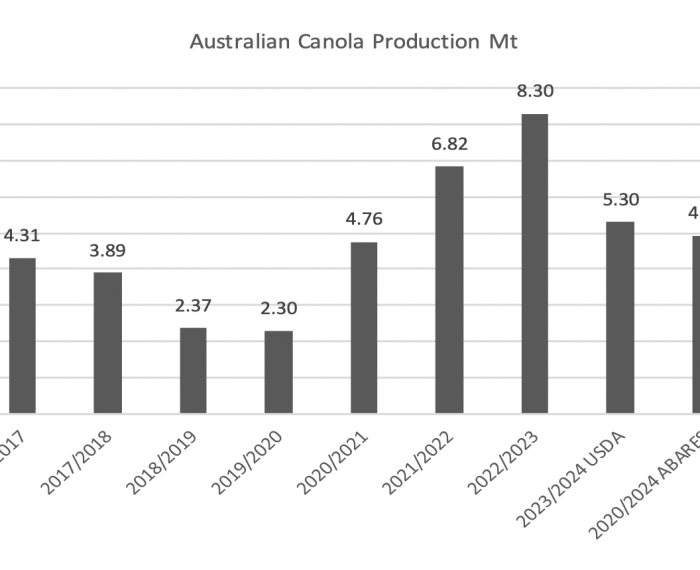

Australia’s agriculture ministry lowered its forecast for domestic canola production in 2023/24 by 480Kt, to 4.9Kt. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

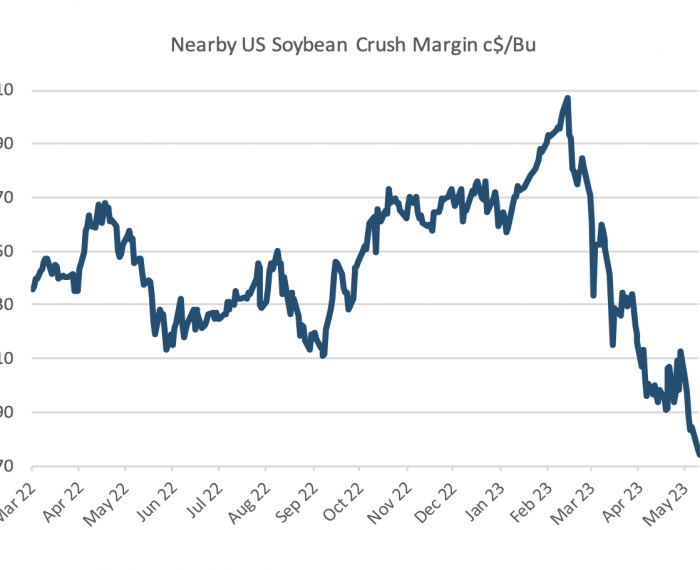

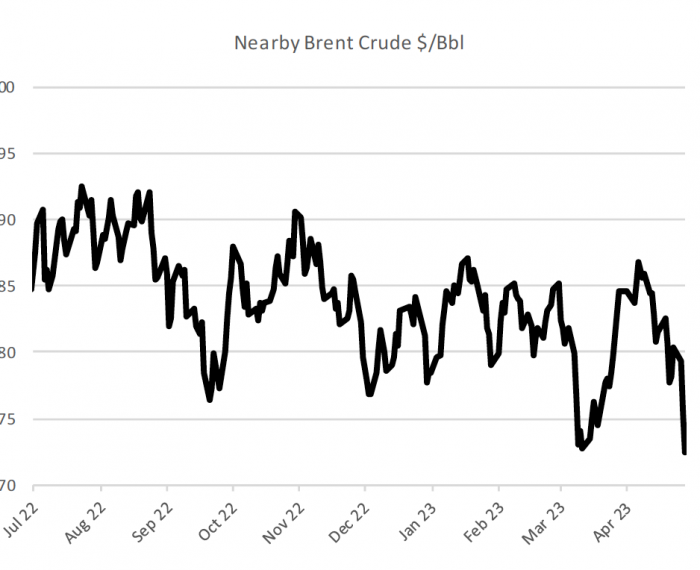

Soyoil has, like other vegetable oils, buckled under the fresh selldown in the crude oil market, encouraged by ideas of steady production at a time when economic worries are undermining consumption. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

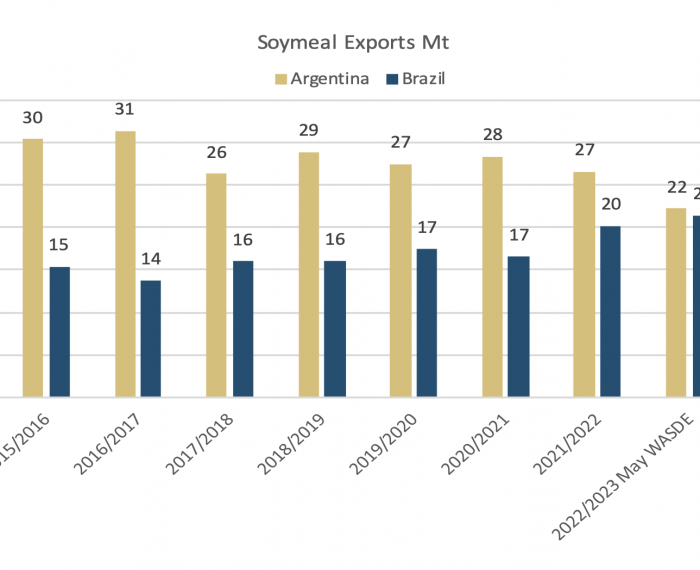

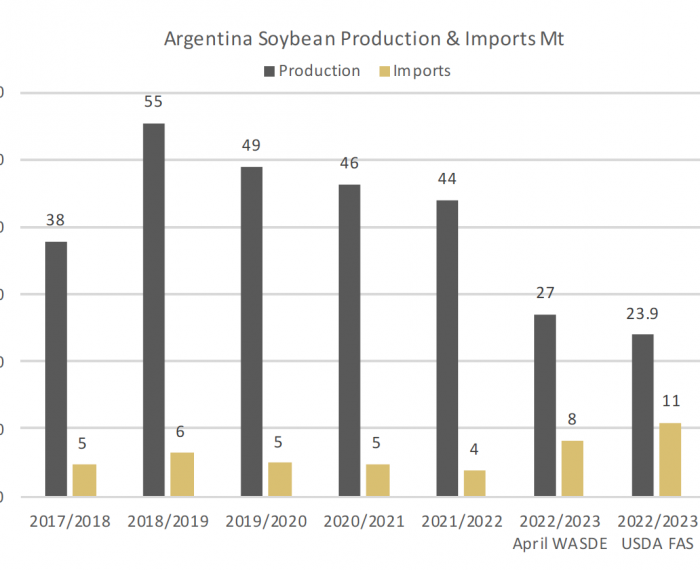

While the Argentine crush is lagging, Brazilian processors have filled a little of the void in international supplies by meeting nearly 1.6Mt oil meal exports for the first three weeks of May. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

From the pointers we have so far, the Wasde looks poised to signal a downward trend for prices, as the US leads expansion in inventories among major soybean exporting countries. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

May’s recovery in vegetable oil prices, so far, contrasts with continued declines in crude oil, an important influence on prices of vegetable oils, which are used largely in making biodiesel. It also runs against the trend of 2023 which has seen prices of the likes of rapeseed oil and soyoil underperform those of Brent crude. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The planted area for sunflowers is due to see a 10% increase above 5-year average and reach 4.8Mha, on account of the temporary derogation from the obligation to allocate a part of the arable land to non-productive areas and a possible switch from corn in drought affected regions. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

With deeper cuts to production, Argentina will have to import a record 11Mt of soybeans to supply its crushing sector. In recent years Argentina has crushed about 40Mt per year and has a theoretical annual capacity greater than 65Mt, supplying close to half of the EU’s meal import requirement. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe