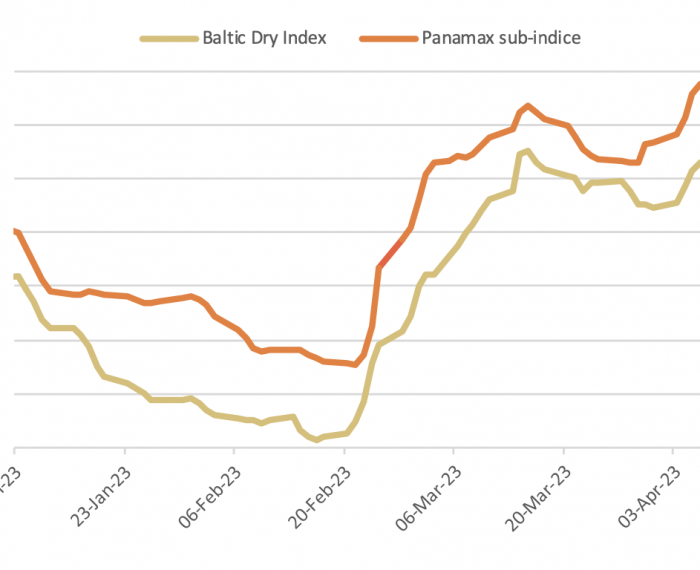

Global supply chain pressures lingered over the past month, with the cost of dry bulk shipping increasing notably. Combined speculative positions in agricultural commodities remain in a net long position, but there remains a large net short position in wheat. Global supply chain pressures lingered over the past month, with the cost of dry bulk shipping increasing notably. Global grain prices will average lower in 2023, but plenty of upside risks remain, particularly due to volatility in energy markets amid still-strong demand. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The grain corridor agreement which expired over the weekend has reportedly been extended, although the details of the terms remain shrouded in ambiguity. Both sides are making different statements with Russia suggesting a 60 day extensions and Ukraine and Turkey stating another 120 days has been added to the agreement. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

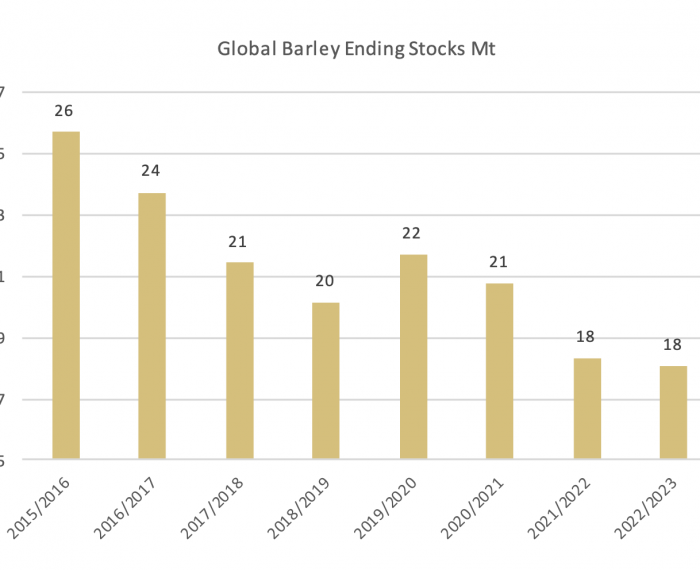

Global grain stocks are poised to end 2022/23 at the lowest in eight years, sapped by adverse weather and geopolitical supply setbacks. Additionally, barley looks unlikely to be top priority in farmers’ sowings for the 2023 harvest. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

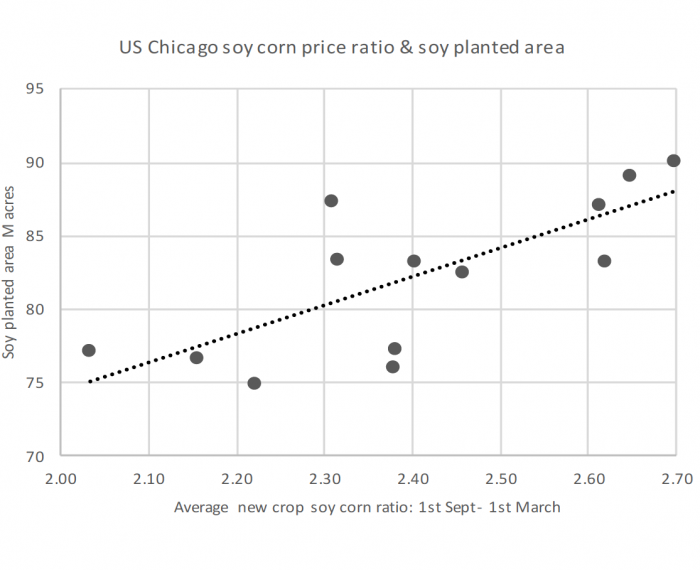

Per acre, soybean fertiliser costs are between 20%-25% those of corn, with the USDA anticipating an average input cost of just $54/acre for soy in 2023, while corn is expected to cost $211/acre. From an input perspective, and as the price of fertiliser has fallen, the incentive for US farmers to favour soybeans has continued to weaken, allowing greater confidence in the outlook for corn. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The Ukraine war is approaching its first anniversary without sign of a resolution. The outlook spells further uncertainty for grain markets, and two countries which between them were, ahead of the war, accounted for 15% of world corn exports, more than 25% of global wheat exports, and 75% of the world’s sunflower oil exports. Russia too is the world’s largest fertilizer exporter. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe