Highlights: • Rapeseed – Prices find support in vegoil market resilience • Soybeans – Chinese import orders, Brazil weather support prices • Crop Watch – Brazil’s planting slowdown Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

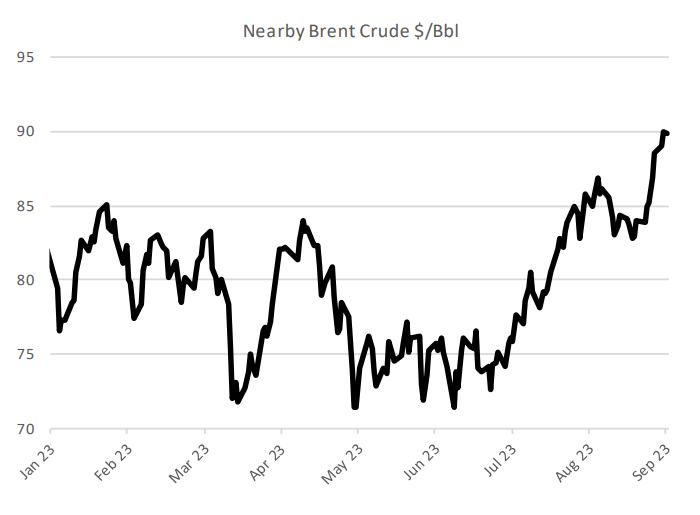

Highlights: The World Bank this week, while forecasting an average of $81/Bbl for Brent crude in 2024, said that prices could top $150/Bbl if the Israeli-Hamas war escalates into regional conflict. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Highlights: • Rapeseed – Rapeseed misses lift from buoyant crude oil • Soybeans – ‘Incredible demand’ spurs soymeal rally • Crop Watch – Low river levels curb Brazil’s exports Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

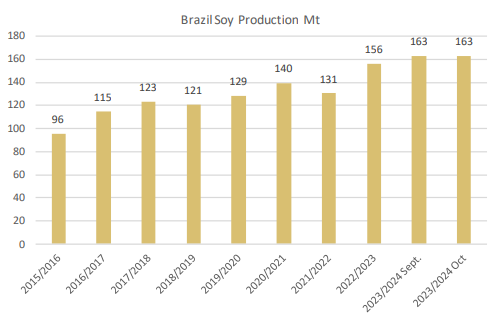

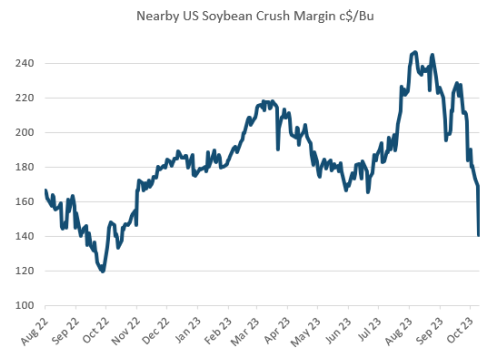

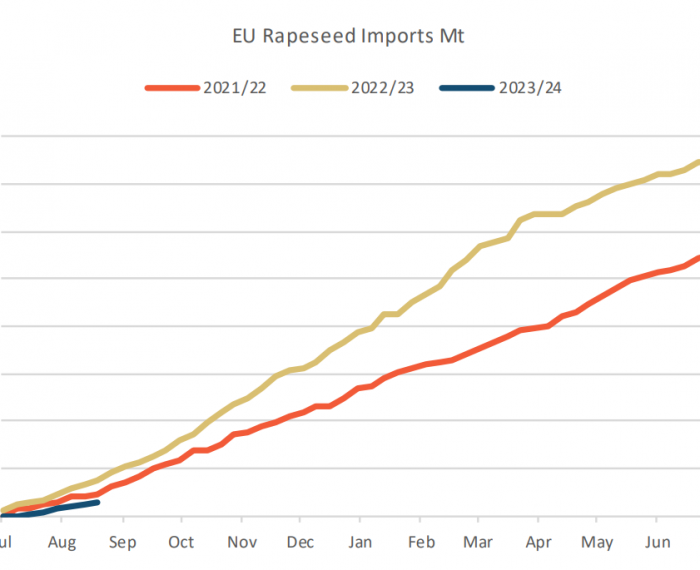

• Rapeseed – EU prices fall, as imports from Ukraine mount • Soybeans – Soymeal, soyoil price falls depress crush margins • Vegetable oil and meal – Rapeseed oil price buoyancy • Crop Watch – Brazilian soybean planting progress Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

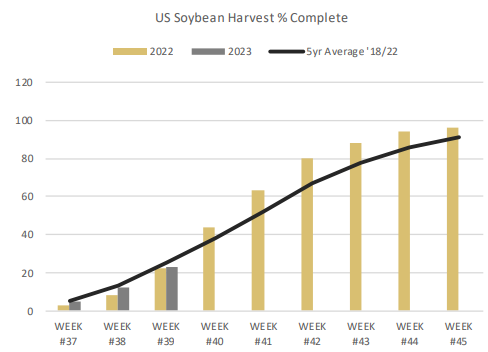

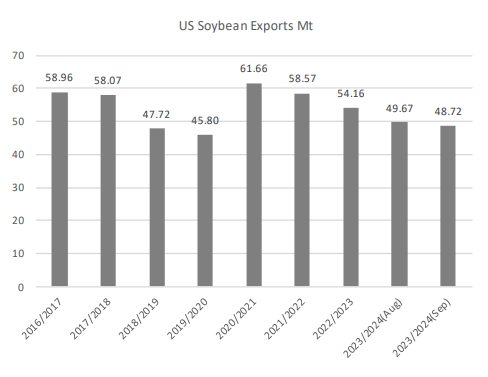

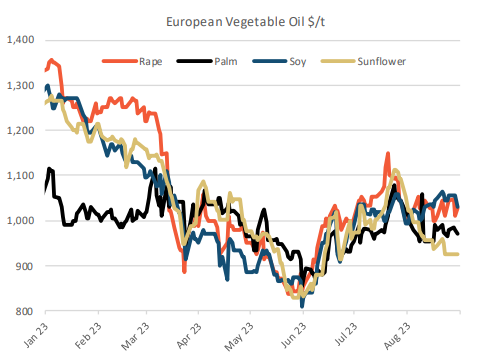

• Rapeseed – Canadian prices stabilize, as exports grow • Soybeans – Market braces for big report, and big month • Vegetable oil and meal – Vegoil prices coalesce as sun rises • Crop Watch – Mississippi river level to hit record low? Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

• Rapeseed – Canadian prices stabilize, as exports grow • Soybeans – Market braces for big report, and big month • Vegetable oil and meal – Vegoil prices coalesce as sun rises • Crop Watch – Mississippi river level to hit record low? Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Rapeseed – Prices outperform soybeans, canola Soybeans – Key period for supply prospects Vegetable oil and meal – Meal market ructions Crop Watch – Brazilian dryness. How long will El Nino last? Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

• Rapeseed – More generous turn in, some, supply signals • Soybeans – Brazil’s planting window opens, cautiously • Vegetable oil and meal – Soyoil turns down invitation to rally • Crop Watch – Australia’s ‘hot and dry’ forecast Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

EU rapeseed imports set to improve. • Rapeseed – Market declines invitations for volatility • Soybeans – After-tour rally runs into demand resistance • Vegetable oil and meal – EU crushers turn to rapeseed, soy • Crop Watch – Australia and El Nino Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

That rapeseed prices are resisting seasonal pressure from the northern hemisphere harvest reflects in part external factors, such as the recovery in crude oil markets Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

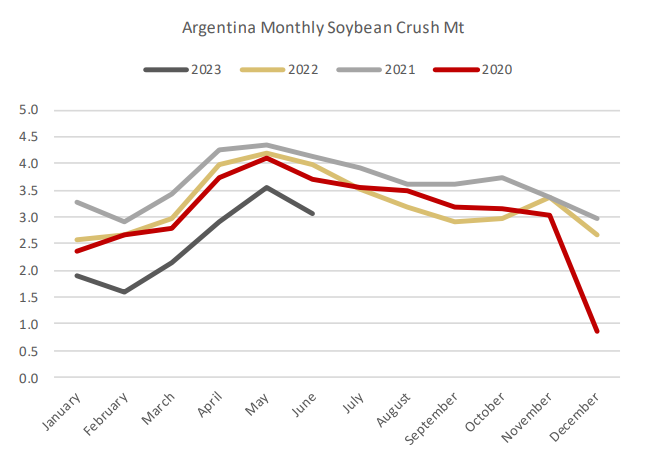

Argentina’s soybean crush shrank by 23% year on year in the first half of 2023. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

El Nino-inspired dryness will curtail South East Asia’s palm oil output, has placed extra emphasis on production dynamics. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe