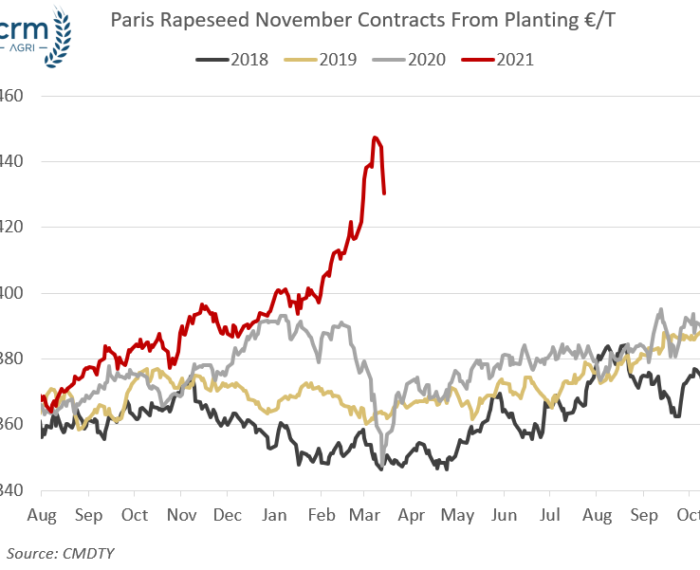

Oilseed rape markets have continued to receive support, but as the focus moves to harvest ’21, the attention has been on the potential additional crop loss in France from the recent cold spell and the continued dryness in Canada. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO is a monthly round-up and outlook of global markets covering grains and oilseeds. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Looking to next season, with reducing areas in the UK, Ukraine, and likely the EU, oilseed rape supply next season will be even more reliant upon a benign spring, and an average to on-trend increase in yield to maintain supply. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

In this video, James Bolesworth and Peter Collier look back at 2020 and focus on the main factors to consider as we approach the 2021 harvest. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

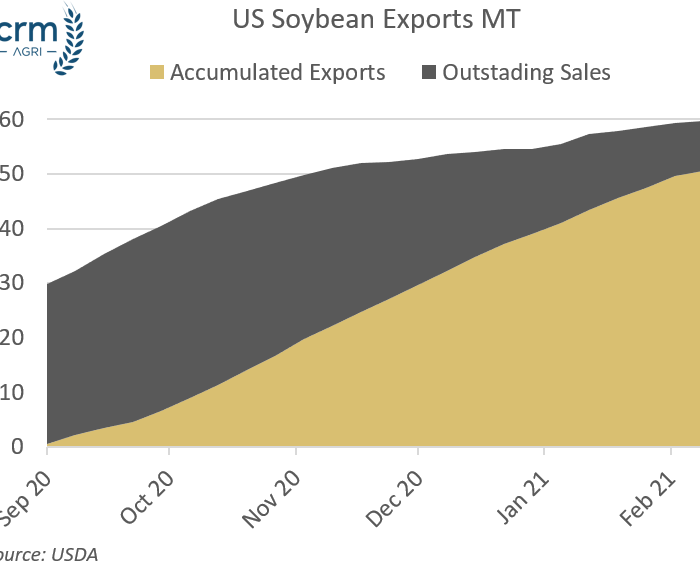

Soy markets, like corn, are caught between the opposing market forces of tight US markets, against larger South American supplies and projections for easing global supply into 2021/22. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The big news for oilseed and vegetable oil markets last week was the jump and continued climb of crude oil markets. OPEC+ surprised markets last week by maintaining production minimal levels, being unwilling to increase production amid long-term covid demand outlooks. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Soy and OSR meal markets are remaining well supported, and from a soymeal perspective, Chicago soy and soymeal markets have been pushed higher as China has been rapidly buying US soybeans and there is a short term squeeze on soybean oil. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO is a monthly round-up and outlook of global markets covering grains and oilseeds. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Soy markets have continued to stagnate, having drifted over the last 4 weeks. Similarly to corn, soybeans are in limbo, caught between the diminished US stocks forecast and the imminent record Brazilian harvest. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

In this short video update, we cover the short, and long-term market factors for wheat, corn, and oilseeds. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The dilemma in soybean markets is that to curtail exports, US prices need only price above South American origins and don’t need to continually climb to ration demand, contrary to the vocal market bulls. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

While there is still a while to go in the current 2020/21 season, and the oilseed rape complex is continuing to receive support from an elevated soybean market, the 2021/22 season outlook is less certain. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe