Wheat futures extended gains, after the USDA, in its first global grain supply and demand estimates for 2024/25, forecast wheat inventories…

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

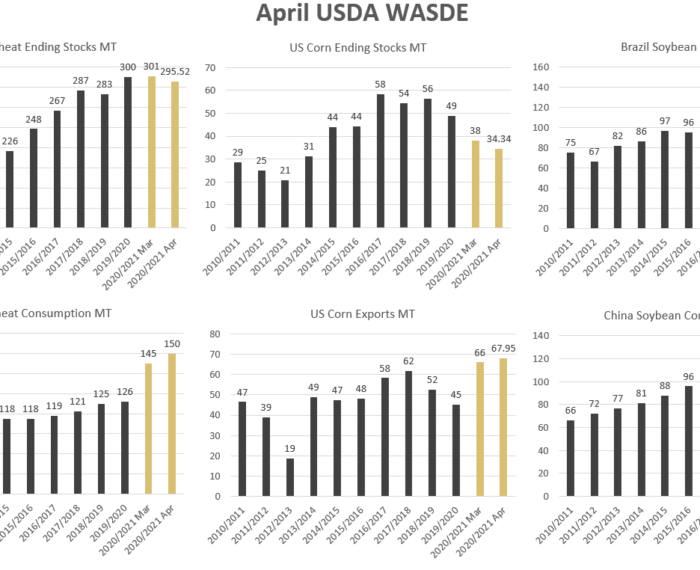

USDAGrains and oilseeds were mixed globally ahead of the April USDA Wasde report. We will provide full analysis of the report…

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Summary of CRM Agri Analysis & Forecasts This afternoon saw a slew of data from the USDA in…

Extract from our full 2024 forecasts and 2023 forecast review Looking back at 2023

Weekly Summary of CRM Agri Analysis & Forecasts It isn’t just basic supply and demand factors, such as crop…

As harvest gathers pace and following the release of the July USDA report, this short video for clients covers: – Global economic drivers – USDA data – Global supply & demand – Oilseeds & veg oils Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

As markets trade sharply lower and following the renewal of the grain corridor, nervousness in financial markets and continued interest rate hikes, we look at what it means for grain and oilseed markets, as well as look ahead to the 2023 crop conditions. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

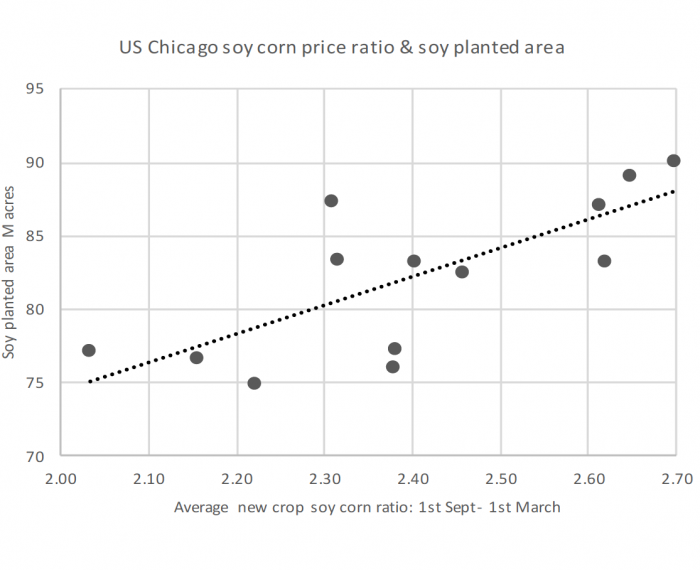

Per acre, soybean fertiliser costs are between 20%-25% those of corn, with the USDA anticipating an average input cost of just $54/acre for soy in 2023, while corn is expected to cost $211/acre. From an input perspective, and as the price of fertiliser has fallen, the incentive for US farmers to favour soybeans has continued to weaken, allowing greater confidence in the outlook for corn. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe