Key charts and data: Includes Macro, wheat, barley, corn, rapeseed, soybeans, vegoils, Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

UK Grain Market Report UK prices Weaker wheat prices encourage exports US tariffs put UK malt in the crosshairs What UK retaliatory tariffs would mean for grains Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Key charts and data: Includes Macro, wheat, barley, corn, rapeseed, soybeans, vegoils, Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Tariffs focus US unveils fresh tariffs US threatens tariffs on EU How could tariffs impact domestic farm prices? Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Key charts and data: Includes Macro, wheat, corn, rapeseed, soybeans, vegoils, Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

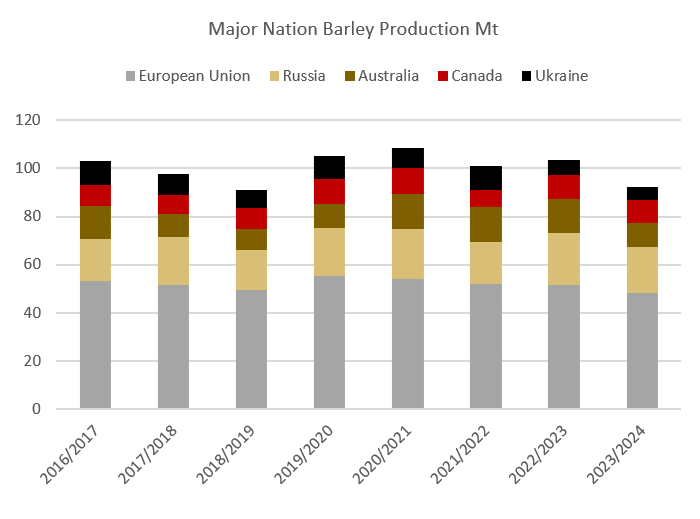

‘The 17.5Mt at which the USDA forecasts world barley inventories closing the season would be the lowest in tonnage terms, and when compared with use, in 41 years. ‘ Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Key charts and data: Includes Macro, wheat, corn, rapeseed, soybeans, vegoils, sunflower Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The persistence of wetness in western Europe has added support to the outlook for barley prices. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

In the EU, barley prices have found, some, support after a poor 2023 harvest, which at 47.3Mt was the smallest in 12 years. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Europe’s barley supplies remain heavy on low demand and increased plantings. In the EU, barley prices have found, some, support after a poor 2023 harvest,…

Global barley is upholding the grain market adage that “small crops get smaller”, as its price buoyancy demonstrates. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Global barley is upholding the grain market adage that “small crops get smaller”, as its price buoyancy demonstrates. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe