Russian Markets Likely To Become Increasingly Opaque

March has proven the bears right, although recent news and market moves have highlighted how fragile grains and oilseeds remain to the global economic outlook, weather and trade out of the Black Sea. In the case of wheat, while prices are lower for the sixth consecutive month, markets have reminded us that it doesn’t take more than a few rumours or speculative news stories to send the bears running for cover and cause the price of this highly politicised crop to rise sharply.

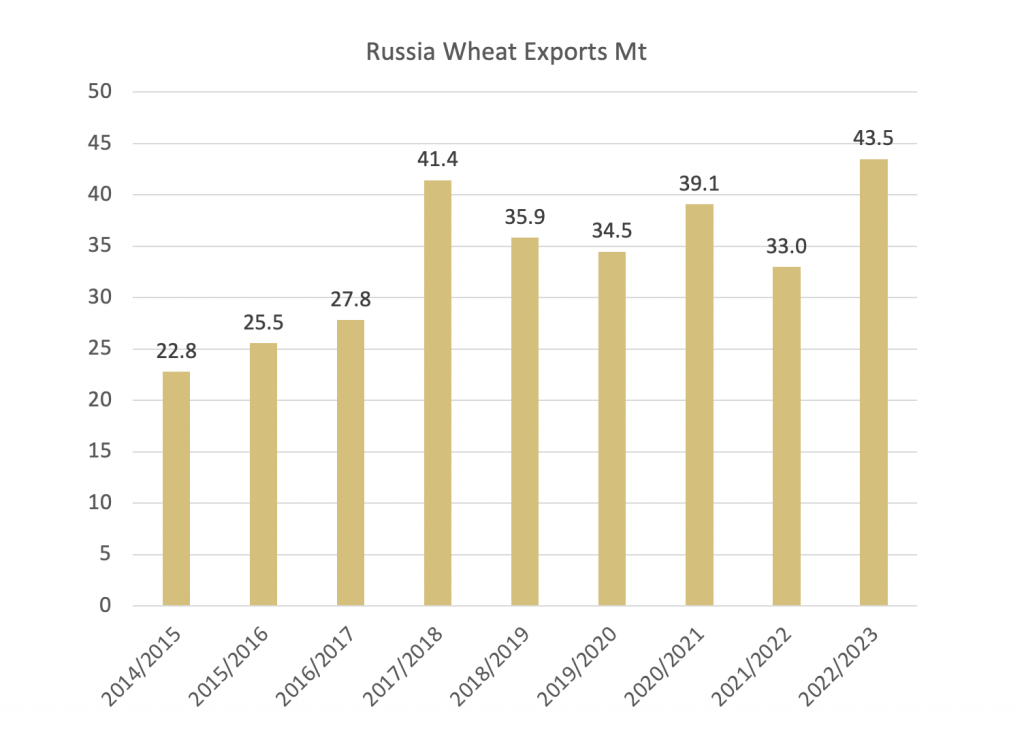

History has shown us how dramatic these moves can be, in 2010 Russia banned wheat exports, causing global prices to more than double in a matter of months. Over a decade later markets are being reminded of the importance of the region’s grain for global food security. It was therefore of little surprise that when rumours began circulating early in the week that Russia could once again ban wheat exports, prices began to rally. We highlighted this risk in our Black Sea Focus Analysis earlier this month.

Then came news that Cargill and Viterra were ‘pulling out of Russia’, adding fuel to the fire and further dissolving the complacency over Black Sea supplies which has become baked into markets in recent months. Subsequent statements from Cargill suggest that the move may not be so dramatic and in fact they will continue export activities, although withdraw from elevation activities (storing at port and loading vessels). However, a statement from Viterra confirmed that they would be withdrawing from both elevation and export activities.

It is likely that Russian organisations will take over these assets and continue to export grains – as is evident from their ongoing acquisition of vessels. The risk now lies in detachment of the Russian grain industry from global supply chains as it looks set to become increasingly state controlled and opaque, elevating the risk that Russian grains could be weaponised in the years ahead at a time when global food security is once again at the top of government agendas around the world.

We highlighted that markets had become oversold in our latest client webinar and was now undervaluing the global fundamentals and war risk, although as we outlined in our latest Global Grain Outlook, the market is not void of downside risks either.

We are entering an important period for global agricultural supply, with expected developments in the war in Ukraine and a more buoyant macro-economic environment. For now markets are now focused on the greatly debated March Prospective Planting report, which will be released later today.

All our latest analysis can be found on the Analysis page.