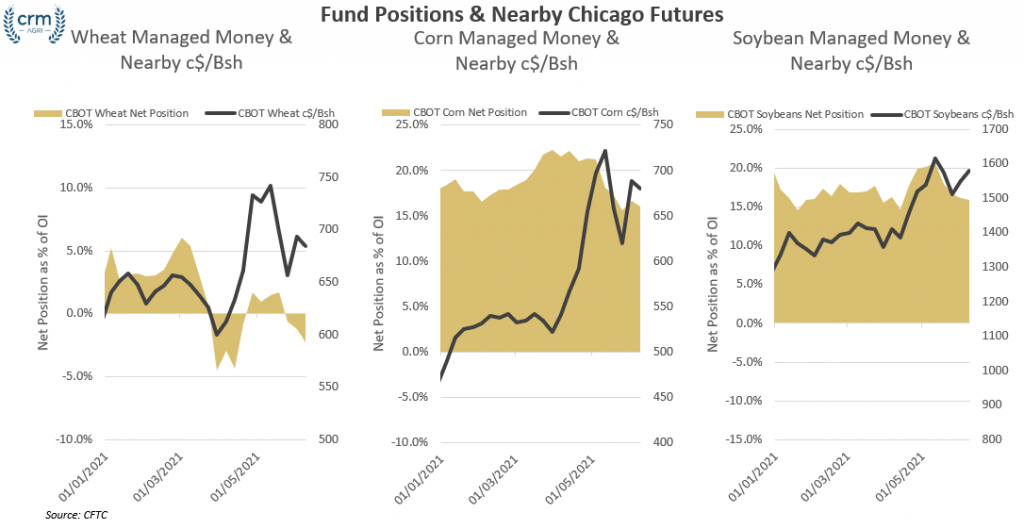

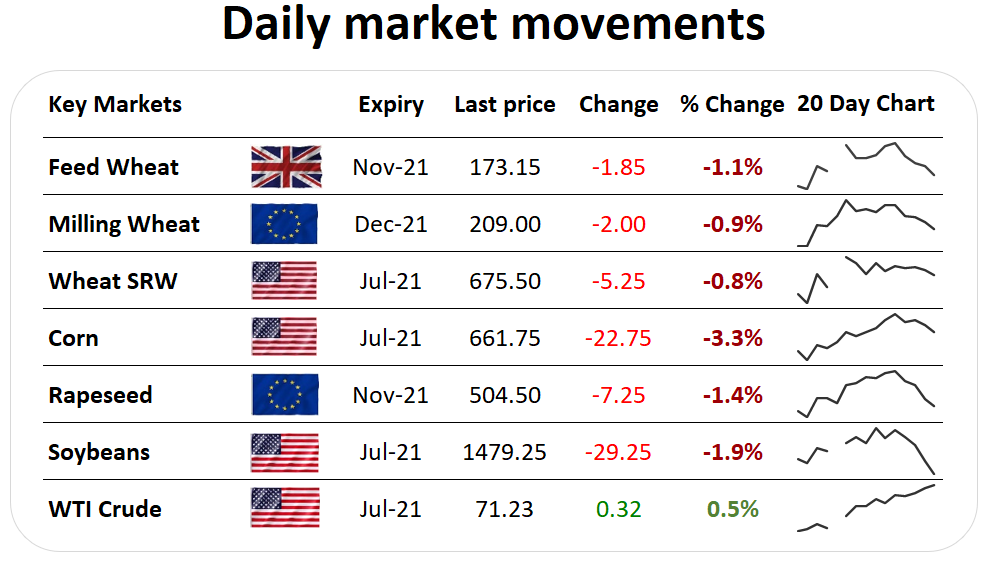

| Across grain and oilseed markets the week has started in the red following heavy rainfall and thunderstorms in the US. Looking ahead and 14-day forecasts have also shifted toward greater volumes of very much needed rainfall in the US key corn, soybean and spring wheat states. The main drivers this week will be the degree of confidence in these forecasts for this needed US rainfall. This week’s USDA crop progress report will be released later today, where the crop conditions of corn will be closely watched. It is still too early for a correlation between condition scores and yield, but still important for market sentiment. Look out for potential further declines for corn crop conditions. Managed money reduced the number of long contracts held in Chicago wheat last week to the lowest number held since July last year, a reflection of increasing global wheat production confidence? While managed money reduced the number of long positions held in wheat, positions in corn and soybeans were virtually unchanged on the week. What does this mean? Globally tight stocks are placing a greater degree of importance upon the 21-harvest, increasing volatility and speculation. The position of funds, while a good metric of market sentiment, can also increase the speed of market corrections. |