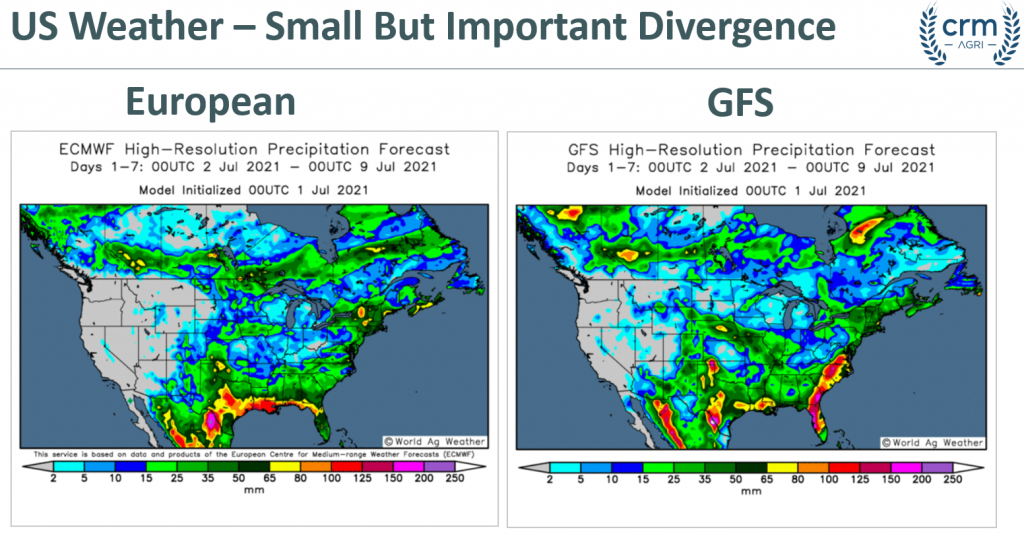

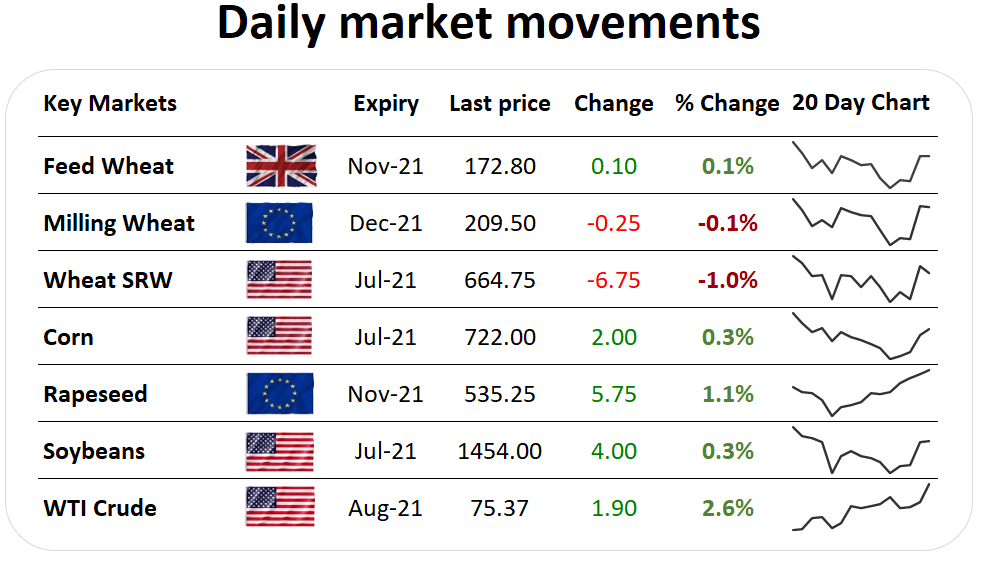

After yesterday’s sharp upward market movement, this morning continued in the same fashion before backing off again. Whether the strong market move yesterday for both corn and soybeans was justified remains up for debate, but now that the Acreage report has been released, the focus is again on weather and today’s weekly export figures. The high temperatures and drought-like conditions across the US and Canadian spring wheat areas remain a concern, having received little rainfall. On the 1-7 day outlook, the GFS and European models are diverging, with the European model predicting more beneficial rainfall. Weekly US corn net sales of just 15Kt for 2020/2021 were down 93%from the previous week and 94% from the prior 4-week average, while exports of 1.137MT were down 33% from the previous week and 36% from the prior 4-week average. Weekly US soy net sales of 92.8KT for 2020/2021 were down 35% from the previous week, but up 62% from the prior 4-week average. For 2021/2022, net sales of 1.67MT were reported, with the bulk for China at 1.147MT What does this mean? While the US planted area continues to be digested, the better chances for rainfall across the corn belt and into North Dakota and Canada removed some of the wind from the sails of the bullish upward market. We are back in a weather market and the focus is now yet again the long-term outlook for US corn and soy. |