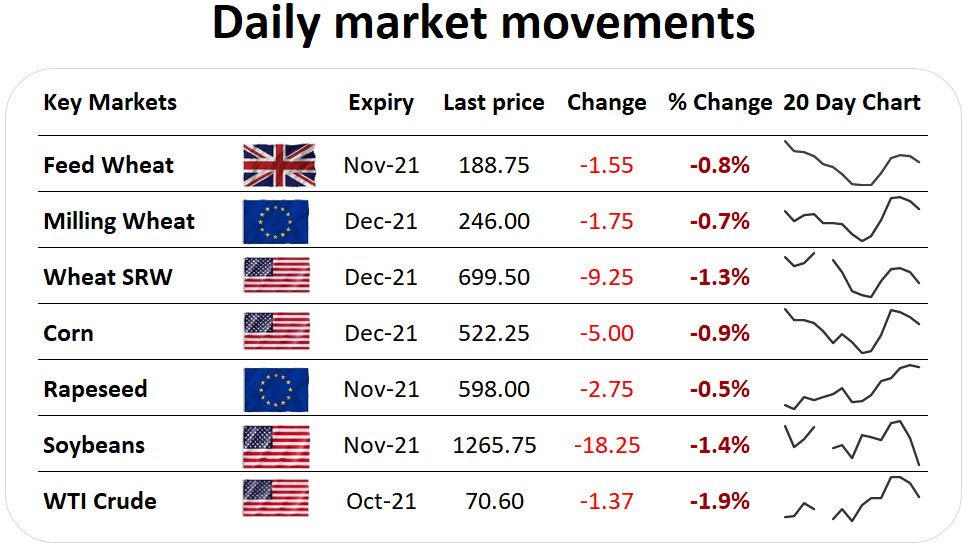

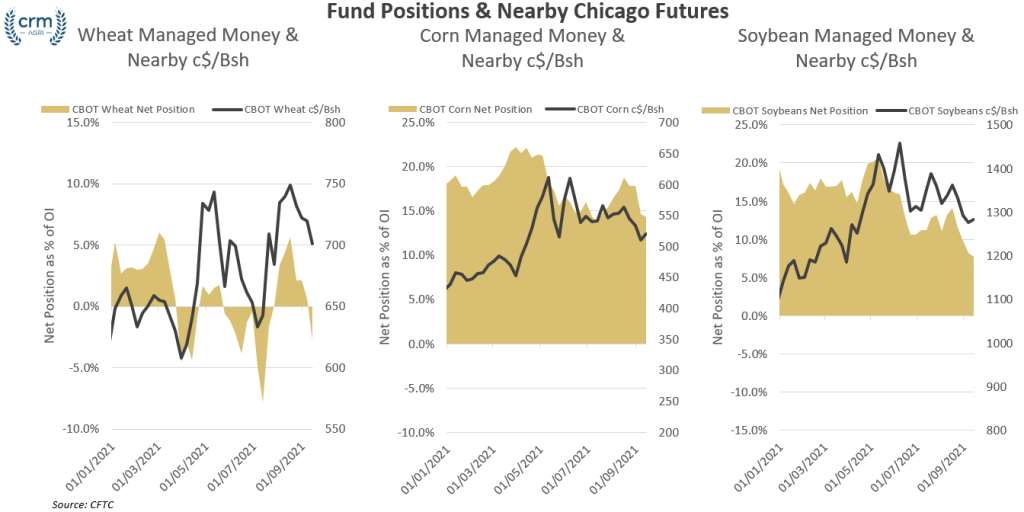

| The start of the week has begun with a risk off approach to work Ag markets, with prices falling across the board and Managed Money have trimmed the number of bullish long positions. Wheat Managed money continued to reduce the number of long contracts held, moving to a net short position in Chicago wheat, reducing the number of long contracts to 64K, down from 76.7K the week before. The Russian wheat harvest has reached 72.3Mt according to the Russian Ministry of Agriculture, while winter sowing has reached 9.7Mha, nearly catching up with last year’s pace (9.7Mha by the 18th September 2020). Corn Managed money sentiment in corn was little changed last week, trimming both long and short positions in corn, but remain in an overall net long position. Read the weekly Grain Outlook on GrainTab Soy Managed money continued to reduce the number of long contracts in Chicago soy last week as Chicago meal and oil markets continue to drift lower. Managed money reduced the number of long contracts to 81.7K contracts, down from 86.7K the week before, the lowest number of long contracts held since May 2020. While soybeans, meal and oil markets have continued to drift, Paris rapeseed continued to push higher, breaching €600/t on Friday before backing off. |

Categories: Blog