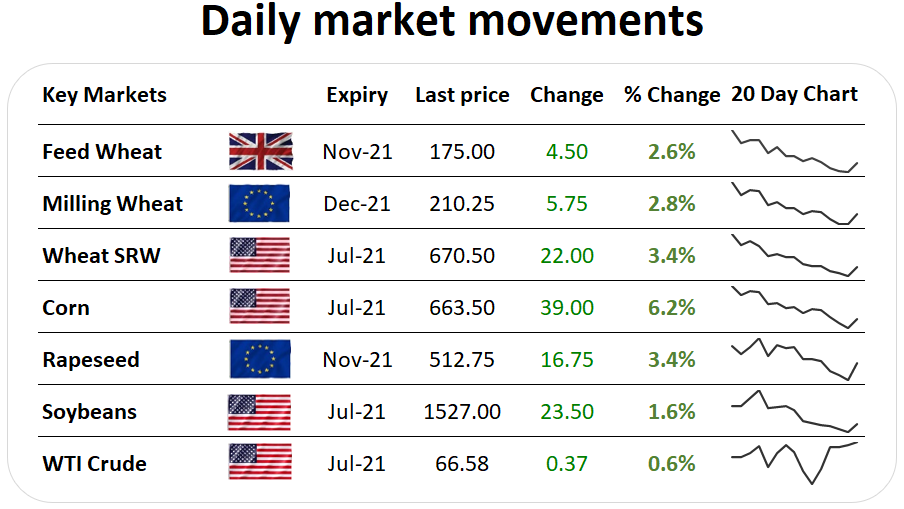

| The main focus today for grain markets has been the release of the anticipated weekly US export sales data. Following last week’s strong sales, this report was always going to make impressive reading. US weekly net corn sales of 555.9KT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. For 2021/2022, net sales totalled 5.69MT primarily for China at 5.64MT. Although China has taken a pause so far this week from making further purchases, markets remain alert for further rapid sales and 5.64MT has been a very impressive headline figure. For wheat, weekly US net sales of just 29.5KT were made for 2020/2021 down 76% from the previous week and 58% from the prior 4-week average, while for 2021/2022, net sales of 373.8KT were made. For US soybeans, net sales of just 55.9KT for 2020/2021 were down 34% from the previous week and 65% from the prior 4-week average. For 2021/2022, net sales of 248.3KT were primarily for Mexico. Why does this matter? Following last week’s exceptional demand for US corn from China, weekly sales data made impressive reading. Following yesterday’s falling market, Chicago corn has recovered from the loss as markets reacted to strong new crop sales, and still strong old crop sales, while Bears in the market had been hoping for old crop cancelations. Weekly US export sales are used as an important data point for the scale of demand for US crops and how competitive the US market is, alongside the knock-on impact on stocks. |