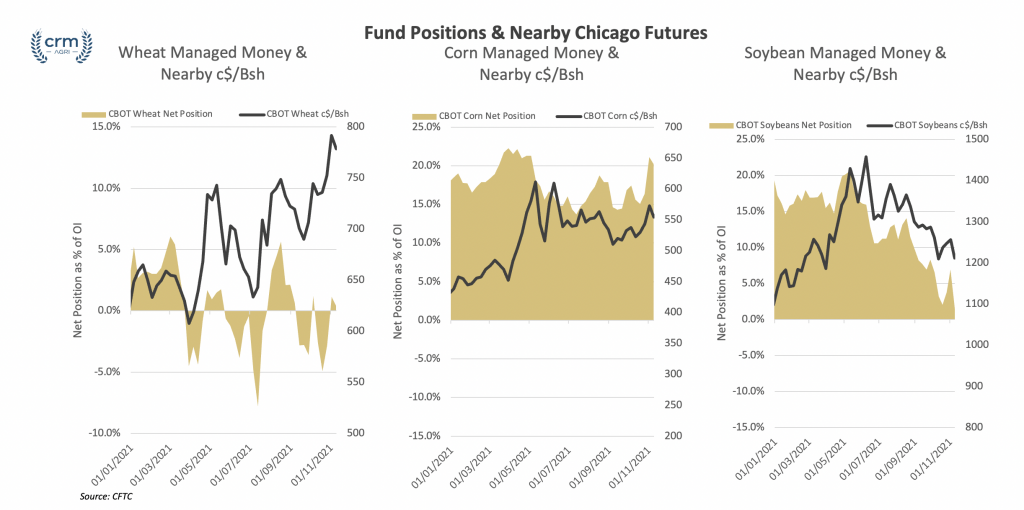

| Managed money data was released last night, and it was a bearish week across the board with funds increasing short positions for wheat, soybeans and corn. For Soybeans, managed money made substantial increases to their short positions, rising from 47.99K positions the week prior to 69.8K. Long positions were reduced from 91K positions the week prior to 79.06K. The move represents the highest number of short soybean contracts held by managed money since June 2020. Looking at corn the number of short positions held by managed money has increased from 27.46K contracts the week prior to 30.68K. There was also a small decrease in the number of long positions held dipping from 346.28K the week prior to 342.32K. For Wheat, the number of short positions held by funds increased from 74.85K the week prior to 79.2K, the number of long positions also marginally increased from 79.46K the week prior to 80.92K. In other news, The Food and Agricultural Organization (FAO) stated in a recent biannual report that they expect a decline in global wheat production in addition to increased demand in 2021/22. Their global wheat production forecast now sits at 770.4MT down 0.8% from the prior year. The downgrade is largely attributed to lower outputs in Russia, Canada and the US. Demand growth is attributed to strong growth in feed use in the EU, China and the UK. |

Categories: Blog