Understanding your ‘basis’ is important to ensure you receive the best price for your grain and how you should be marketing it.

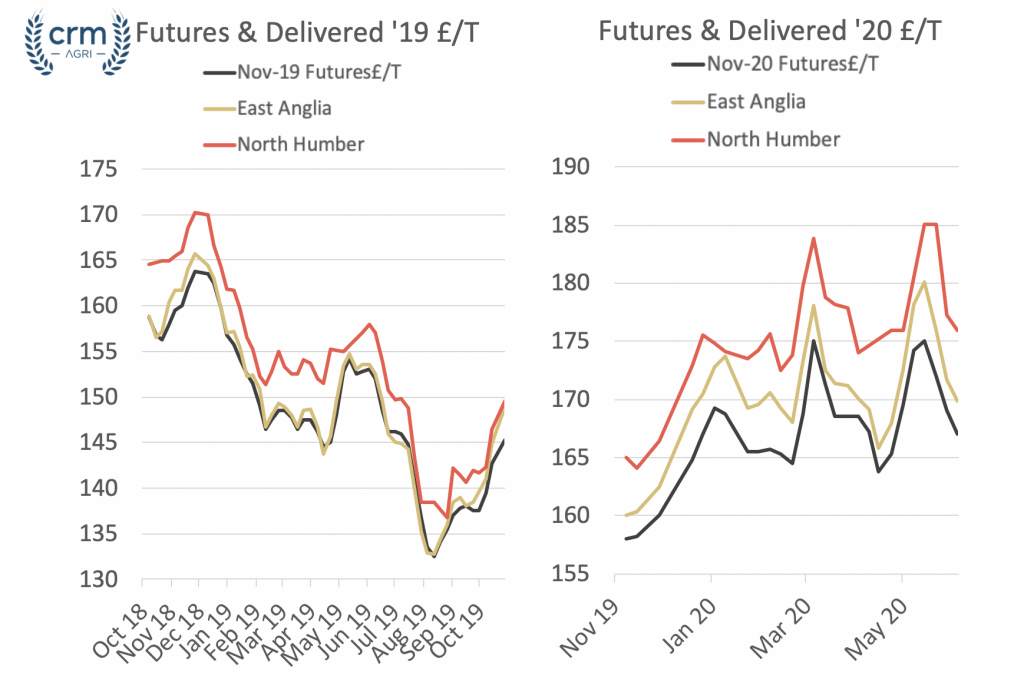

UK feed wheat futures are driven by many factors including the size of the UK wheat crop, currency and the direction of global markets, but there are also important more regional factors effecting the price of grain on farm which need to be understood in order to build a grain marketing strategy.

The delivered market sets the regional price of grain, funding the haulage required to move grain to end users. The ex-farm price is then calculated by working back from the delivered market, with the distance from farm to end user dictating the haulage discount. This is where knowing the end users location becomes an important consideration when selling grain. It is through this that knowing the regional trends and the regional relationship from the delivered market to futures (which is called BASIS) becomes an important factor for pricing grain on farm and ensuring you receive a true market value.

An understanding of the delivered market, and the relationship to futures can also be particularly important for those able to extract value by delivering grain themselves or knowing whether or not there is an opportunity to be hedging or using options (we will cover this in a later post).

What do futures represent? Unlike Paris milling wheat, or other similar futures contracts, there is no fixed delivery point for UK feed wheat futures. Instead, UK feed wheat futures represent grain stores throughout the country, but with a focus in East Anglia – This is why futures are a useful benchmark for all farmers nationally. list of all registered stores

The volume of grain kept in these stores also changes as grain is delivered to end users against contracts or for exports. As the volume of wheat in these stores changes, so does the BASIS (the difference between futures and the physical market). A large volume of grain at a port side futures store such as Ipswich Grain Terminal, in a season where exports are minimal can lower futures markets and diverge from the physical grain market.

Tenders and stock figures can be viewed below, the Dewing Grain South Pickenham Estate store near Kings Lynn has been one of the most active stores. view here

Yet while futures can change, and not always represent the physical market, the regional relationship changes too. Keeping up to date with the regional physical market will remain important not only for those able to deliver grain to customers but to ensure that ex-farm offers are reflecting regional changes.

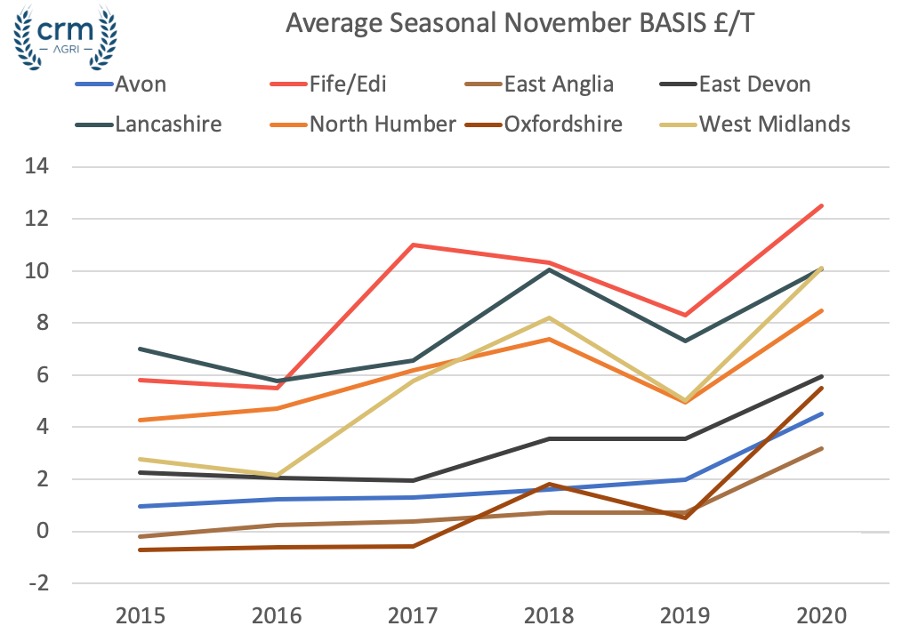

BASIS – The Physical market premium to futures

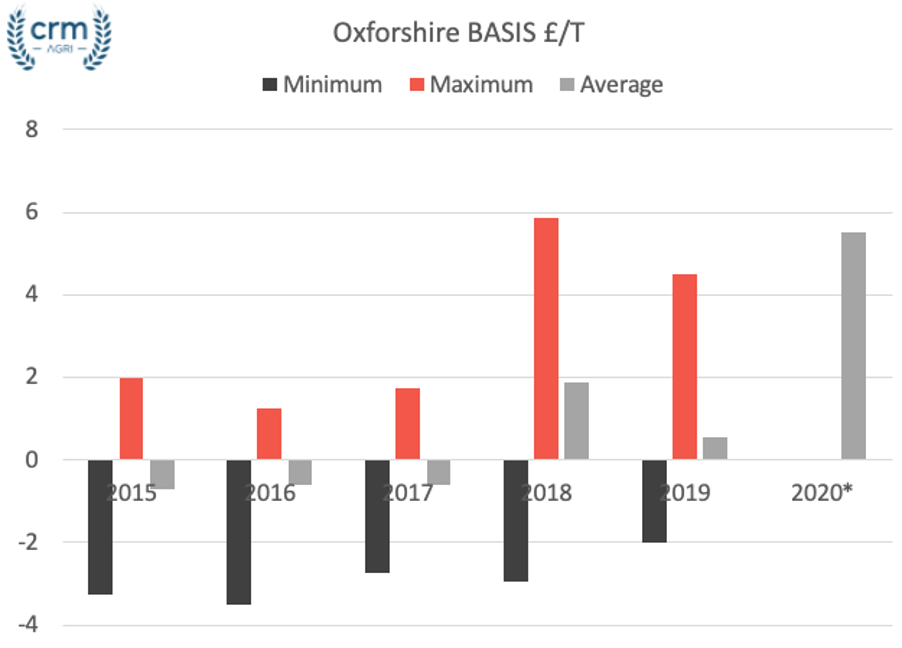

Oxfordshire

Being in the middle of the country, wheat delivered in Oxfordshire traditionally prices as the cheapest grain relative to futures. Yet following the wet autumn and challenging year, the regional pricing of wheat in Oxfordshire is currently elevated above East Anglia and Avon, Basis is Oxfordshire is therefore ‘strengthening’’.

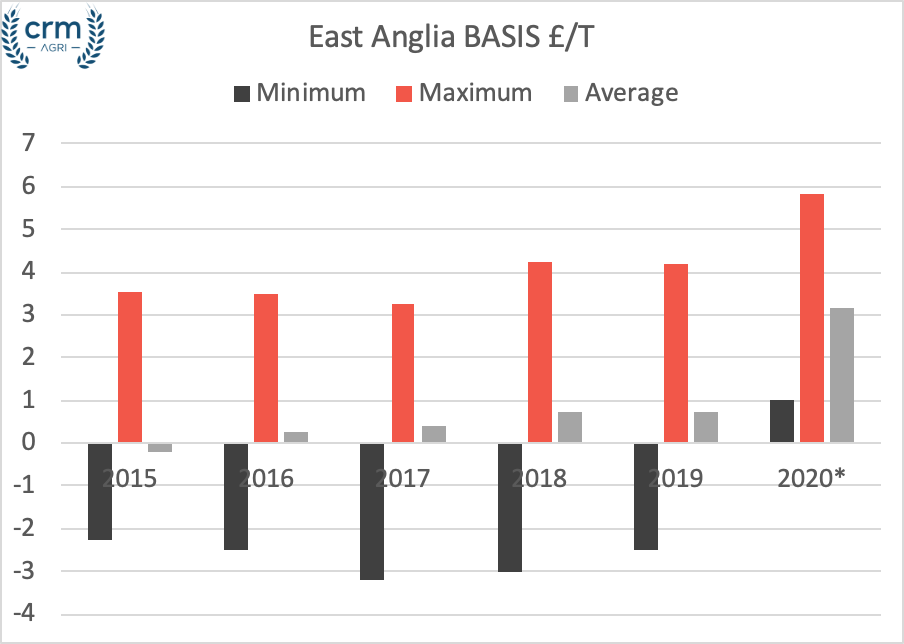

East Anglia

In much the same way that Oxford prices at or near that of futures, with the majority of stores in East Anglia, the BASIS remains fairly consistent, with delivered values up to £2/T over that of futures. The exception is often prior to harvest when yields are uncertain and new crop BASIS for November delivery is often elevated.

East & West Midlands

The relationship to futures in 2020/21 in the East and West Midlands has been trading at elevated levels due to the reduced planted area and yield uncertainty. With new crop delivered feed wheat (BASIS) in the West Midlands having stretched close to £10/T above that of November futures, the local basis has near doubled year on year.

Northern England

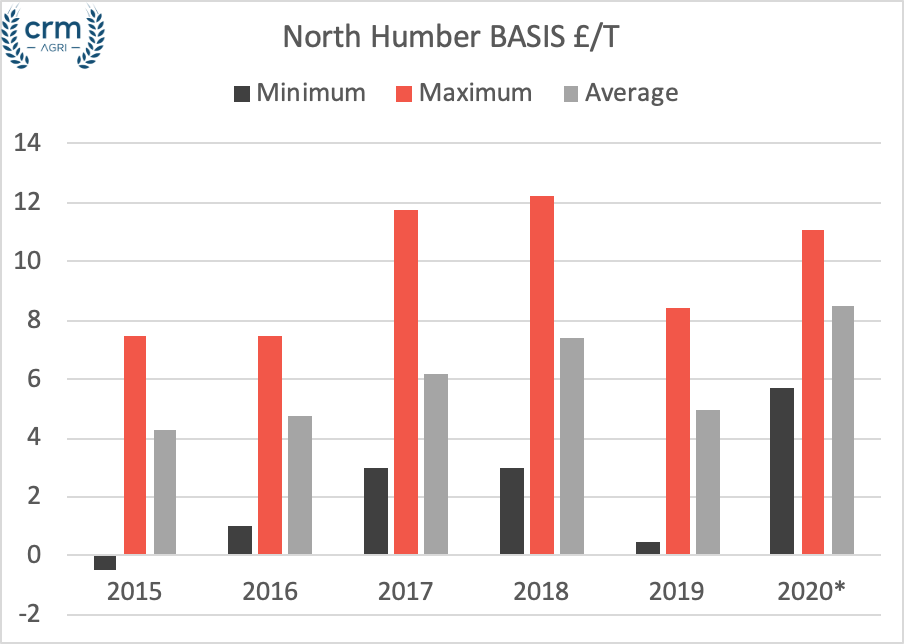

Pricing at a level to allow grain to travel north, the BASIS increases in the north of England. Yorkshire, especially the North Humber however has the added element of the bio ethanol industry increasing regional demand and increasing the regional BASIS. At times of high reginal demand and reduced supply, BASIS moves as high as £10/T over futures, and as low as £3/T in periods of reduced demand. Current New Crop North Humber values are nearing £10/T as the prospect for a reduced northern supply is supporting regional values.

Knowing your basis will allow you to understand if its time to sell, hedge, use options or whether you should be delivering grain yourself.

If you would like more information on how you can use Basis to maximise grain marketing opportunities get in touch info@crm-group.co.uk