| Grain Deal And Market Volatility: A Hectic Week’s Highlights

Global grain prices took a slight knock over the past week, predominately due to the market reaction to the 120-day extension to the Black Sea grain corridor deal and more favourable weather in drought-stricken South America, while a notable drop in crude oil prices also should have dragged on agricultural markets somewhat.

Both US and European wheat prices dipped slightly, as did US soybean and EU rapeseed. Nevertheless, US corn prices gained this week on the back of healthy weekly export sales data, but EU corn markets lost some support—predominately due to the fall in European wheat.

It was a relatively busy start of the week as the latest data revealed Managed Money, speculative investors, were active over the past week. Long positions in US corn futures dropped to the lowest level since early October, while short positions surged to the highest level in four months in the week ending November 7th.

Moreover, Managed Money’s short positions in US wheat increased to the highest levels since early February—before the war in Ukraine broke out—and now stand at 98,895 positions held, which highlights the growing bearish sentiment in wheat markets.

Managed Money’s recent trend for a growing bullish position in US soybeans was questioned as the pace of additional long positions being taken slowed.

In terms of US harvest and planting progress, corn and soybean harvests have virtually concluded, sitting respectively at roughly 93% and 96% complete.

US winter wheat planting remained well ahead of its average for this time of year and is also nearly complete, while conditions scores improved despite being down from this time last year.

US ethanol production took a slight knock over the past week, falling to a 5-week low, but inventories also fell more than markets were expecting, suggesting demand remained firm.

Corn prices also benefitted from weekly export sales coming in at 1.17Mt following strong sales to Mexico.

Overall, global grain markets were overshadowed by the announcement from Ukraine, Russia, and Turkey to extend the Black Sea grain corridor deal on November 17th.

The deal was set to expire on 19 November, but Russia and Ukraine were able to reach an agreement to continue allowing the safe passage of grain exports.

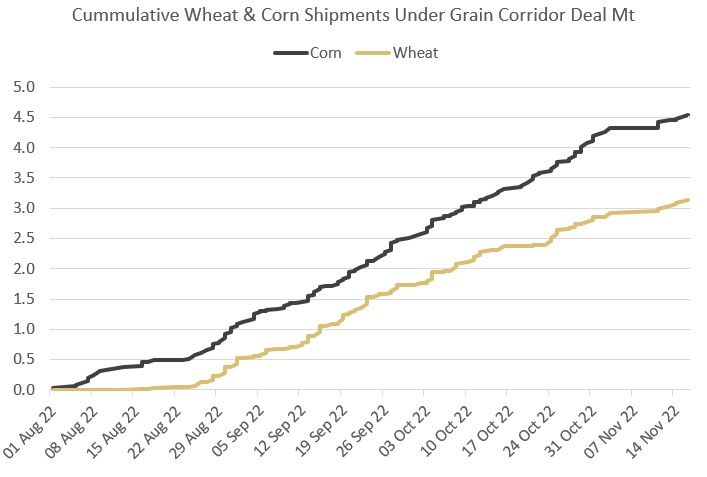

The corridor has been responsible for shipping over 11Mt of grains out of Ukrainian ports since it began back in August. Despite Russia briefly pulling out of the deal at the start of November, which led to a significant slowdown in the loading of grains to ports in Ukraine due to uncertainty around the longevity of the deal in recent weeks, the extension should ensure a healthy flow of grains over the next couple of months.

Consequently, global wheat and European corn and oilseed rape prices were dragged down by easing supply pressures.

Nevertheless, there still remains significant uncertainty around the longevity of the deal. Russia is seeking to remove sanctions that they claim to be causing financial challenges for the export of Russian goods, including food and fertiliser.

However, it is unclear what those obstacles are as Russian food and fertiliser are not subject to sanctions by the US and EU, and it is difficult to determine whether the West will be willing to make concessions on its current set of sanctions.

Russia stated it will stand ready to pull out of the agreement if they do not receive unhindered access to international markets for its food and fertiliser exports.

|