Europe’s barley supplies remain heavy on low demand and increased plantings.

In the EU, barley prices have found, some, support after a poor 2023 harvest, which at 47.3Mt was the smallest in 12 years.

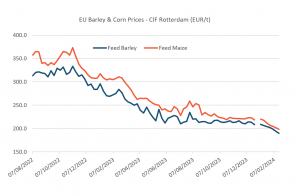

While flat prices on the Continent have continued to decline since harvest, they have not done so as much as wheat, allowing the feed barley discount to narrow to €12/t basis Rotterdam, from a summer average of just over €18/t.

In the UK, by contrast, the barley discount, currently at £23/t, has stayed fairly flat and wide since summer, missing out on the strengthening often seen late in the calendar year as the coming of winter encourages feed needs.

UK supplies have been bolstered by a reasonable harvest-23 on top of ample carry-in stocks. Yet the UK is struggling to find buyers for its barley now that the EU has been sourcing what grain imports it needs (and more) from Ukraine.

Looking ahead, other origins look likely to see wider barley discounts taking hold too.

The issue isn’t just that world looks like ending 2023/24 with a little more barley than had looked likely. Inventories will still be squeezed, but no longer on track for the 40-year low that the USDA had suggested earlier in the season.

The International Grains Council now foresees an 11-year low, while the USDA has last week lifted its forecast to a two-year low, of 18.4Mt, albeit a number still well below average.

Also eroding prospects for barley values it the fact that the grain does not, from where we sit now, look like it will need to fight so hard, through price, for area for harvest-24.

Europe, particularly the UK, looks set for an extensive spring barley sowings programme, given the expanded area seen available for planting, after a rain-curtailed autumn seedings campaign, and the limited palette of alternatives.

Corn, a major rival on the Continent for spring sowings, is looking a much less attractive alternative than last spring, when its price was buoyed by a poor EU harvest-22. Corn’s premium to barley has shrunk to €8/t basis Rotterdam from €32/t a year ago. Corn is a more expensive to grow too, if higher yielding.

source: EU Commission

Similarly, spring barley sowings are expected to expand in Ukraine too, more than offsetting a decline in winter crop area.

Canada is the one major northern hemisphere origin currently expected to see a dip in barley area, as price differentials encourage growers to allocate more land to oats and pulses.

In the southern hemisphere, meanwhile, early indications for Australian barley sowings are upbeat, although the persistence of dryness in some areas could deter overall crop plantings if it lasts until April-May.

In Western Australia, Australia’s top barley-producing state, industry group Giwa said this week that “barley is back in favour due to its’ relative grain yield performance compared to wheat recently, and the re-opening” of China, the biggest barley importer, to exports of Australian barley.

China, after ditching a three-year de facto ban on Australian barley, imported 1.5Mt in Q4, out of a total of 4.1Mt from all origins.

In fact, Chinese barley imports, after a sharp rise last year to 11.3Mt, are expected to decline ahead, in the face of the enhanced competitiveness of corn, and the challenge to feed needs from hog herd contraction.

There is, of course, still the potential for upsets to the supply picture. In France, for instance, there is growing concern over the early pace of spring barley seedings.

In fact, worry is misplaced that the headline 2024 progress reading, of 26% as of last week, is so far behind last year’s 77% figure. Planting in 2023 was unusually rapid. This year remains ahead of the previous five-year average, up to 2022, of 22% completion.

What is more noteworthy is the diverging fortunes between different regions of France, with farmers in sodden northern areas getting off to an unusually slow start, while those in the south west surge ahead.

Further wetness could yet curtail French spring barley area in the north and east, with potential read-throughs too to elsewhere in northern Europe, including Denmark and the UK. There is talk of an increase in French malting barley premiums for harvest-24, even as the Creil premium for old crop, at about €85/t FOB, remains more than twice the €35/t recorded a year ago.

Nonetheless, as things stand, barley looks likely to main a large price discount to wheat, given the likely substantial presence of barley in Europe’s spring planting programme.