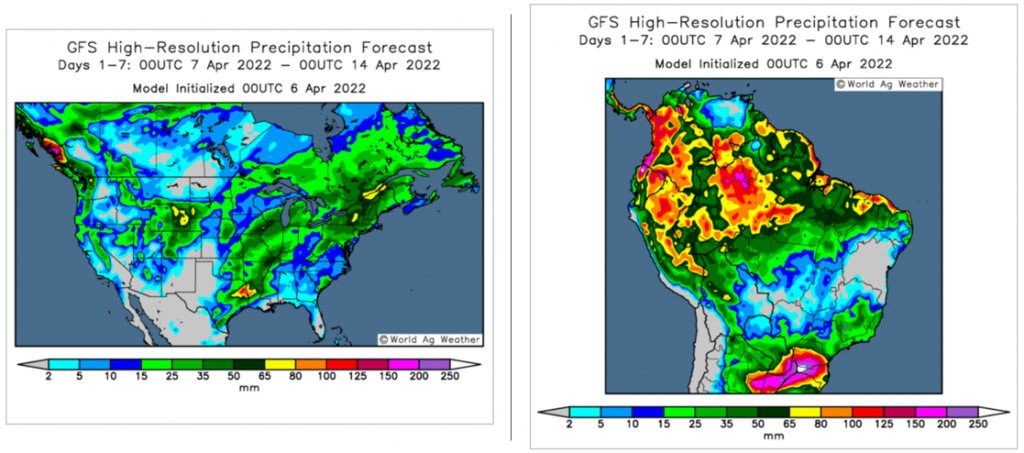

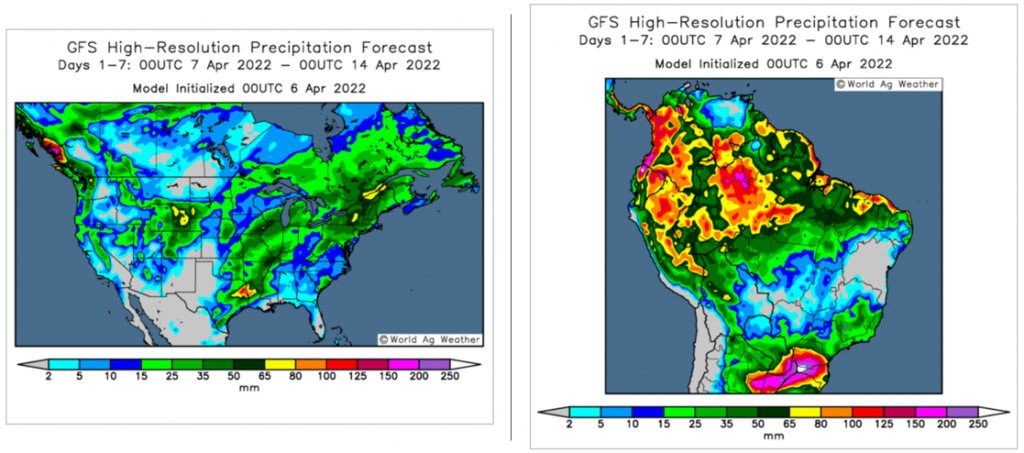

| Markets have generally been under a degree of pressure today, but high winds and a lack of moisture in the US continues to support new crop wheat markets and rainfall remains absent from the 7day outlook for much of the US winter wheat area.

The Ukrainian Grain Association has requested that the government lift the remaining wheat export restrictions given the large volume of stocks. However, the feasibility to conduct exports remains a large uncertainty, but the request is notable and provided a degree of pressure for old crop wheat markets.

Dryness concerns for Brazilian corn are also beginning to creep back into markets, with patchy rainfall forecast and drying conditions across parts of the Brazilian second corn area.

Weekly US ethanol production at an estimated 1003k barrels per day has fallen to a 5 week low, and the second lowest volume produced since the start of the year.

The USDA have released their annual Indian oilseeds and products report, highlighting a forecast for continued growth and reliance on imported vegetable oils, forecast to reach 14.5Mt in 2022/23, up 6% year on year. Read the full report here |