GGO compliments our weekly insights, providing monthly longer-term analysis, S&D and price forecasts of global markets and prices covering the grains and oilseeds. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Speculative investors reduced their long positions held notably since mid-October, pointing to significantly less bullish sentiment among speculative investors towards agricultural commodities as an investment vehicle Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Speculative investors reduced their long positions held notably since mid-October, pointing to significantly less bullish sentiment among speculative investors towards agricultural commodities as an investment vehicle Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Analysis covering what is behind the rise in fertiliser prices, what could cause fertiliser prices to retreat and the impact upon farm margins and historical comparisons. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Analysis covering what is behind the rise in fertiliser prices, what could cause fertiliser prices to retreat and the impact upon farm margins and historical comparisons. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Analysis covering what is behind the rise in fertiliser prices, what could cause fertiliser prices to retreat and the impact upon farm margins and historical comparisons. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Speculative investors reduced their long positions held notably since mid-October, pointing to significantly less bullish sentiment among speculative investors towards agricultural commodities as an investment vehicle Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

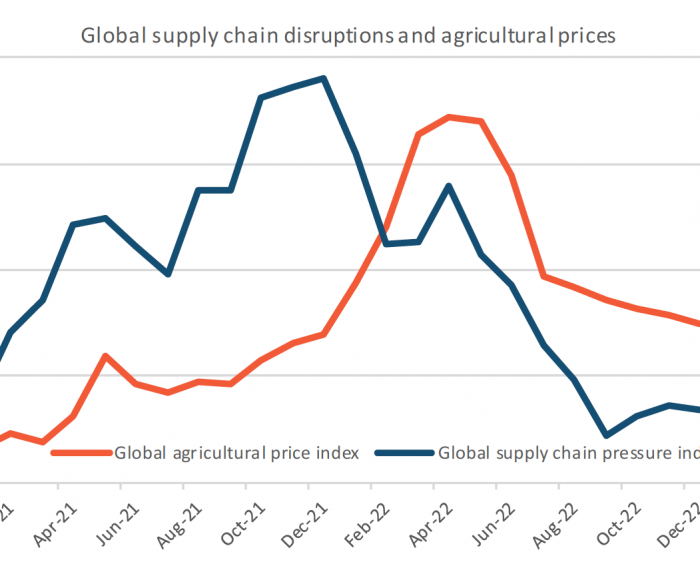

Moderating global economic demand—particularly from China due to its zero Covid-19 mandate—is expected to weigh on purchases of wheat, corn and soybeans, while weaker global growth should see crude prices pullback, leading to potential pressure on the vegetable oil market. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Analysis covering what is behind the rise in fertiliser prices, what could cause fertiliser prices to retreat and the impact upon farm margins and historical comparisons. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Analysis covering what is behind the rise in fertiliser prices, what could cause fertiliser prices to retreat and the impact upon farm margins and historical comparisons. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Moderating global economic demand—particularly from China due to its zero Covid-19 mandate—is expected to weigh on purchases of wheat, corn and soybeans, while weaker global growth should see crude prices pullback, leading to potential pressure on the vegetable oil market. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Moderating global economic demand—particularly from China due to its zero Covid-19 mandate—is expected to weigh on purchases of wheat, corn and soybeans, while weaker global growth should see crude prices pullback, leading to potential pressure on the vegetable oil market. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe