CRB index sinks on weak crude oil prices Dry bulk shipping costs declines after its December rally on better prospects for the Panama Canal US dollar finds some support in early January after falling sharply in December Global interest rate cutting cycle called into question due to rising US inflation Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The Baltic Dry Index reached the highest level since June 2022, due to strong demand for base metals and grains. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

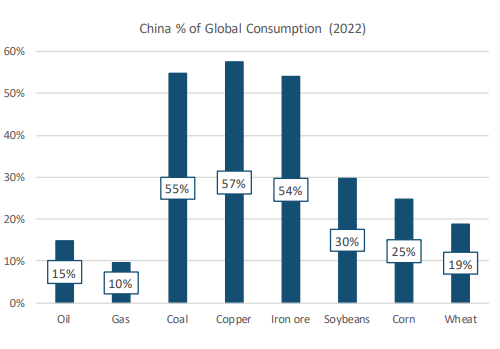

As the world’s largest commodity buyer, China’s economy plays a pivotal role in determining the future direction of agricultural prices. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Latest conflict in the Middle East could push crude oil prices above $100/Bbl before the end of the year, boding well for grain markets. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

As the world’s largest commodity buyer, China’s economy plays a pivotal role in determining the future direction of agricultural prices. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Fertiliser spot price averages stayed on their downward trajectory since the start of the year, predominately driven by replenished global supplies and lower natural gas prices… Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Climate change poses a risk to more volatile yields, while also driving demand for biofuels, providing long term support for global grain prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe