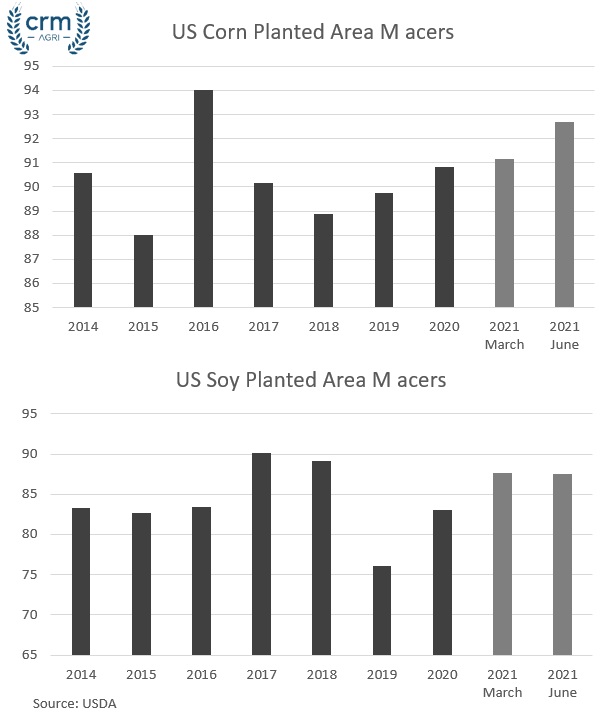

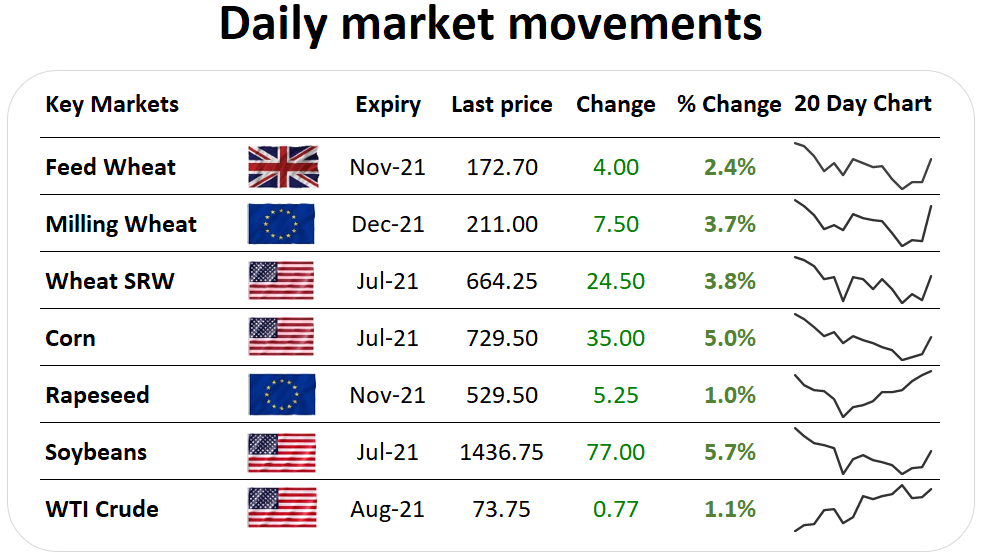

Two major reports, both from the USDA were released this afternoon, the much-awaited June Acreage report, with updated US planting estimates, and stocks report. Corn Corn area revisions in the June planting report were marginally revised upward, disappointing markets expecting a greater area increase. Owing to the strong price incentives markets were expecting a greater increase in area, but with an increase nonetheless, corn prices moving to ‘limit up’ is a very large reaction. In the other important USDA report, corn stocks in all positions on June 1 are down 18 percent from June 1, 2020. Of the total stocks, on-farm stored corn is down 39 percent from a year earlier. Although off-farm stocks are up 11 percent from a year ago. Soy Updated US planted area estimates for soybeans also disappointed markets, with March estimates trimmed from those made in March. The planted area for 2021 is estimated at 87.6 million acres, up 5 percent from last year. Soybeans stored in all positions on June 1, 2021 are down 44 percent from June 1, 2020. On-farm stocks down 65 percent from a year ago. Off-farm stocks down 27 percent from a year ago. However, indicated disappearance for the March-May 2021 quarter was down 9 percent from the same period a year earlier. What does this all mean? It is unclear how both corn and soy areas were both expected to have increased in the US in the latest June planting estimates, however, with stocks tight for both commodities in the US and crop conditions far from ideal, the planting report provided the catalyst for bullish speculators. Read the full Acerage report here Read the full Stocks report here |