We recently launched a new service the ‘Global Grain Outlook’, this monthly forecast looks beyond our usual analysis to provide forecasts on…

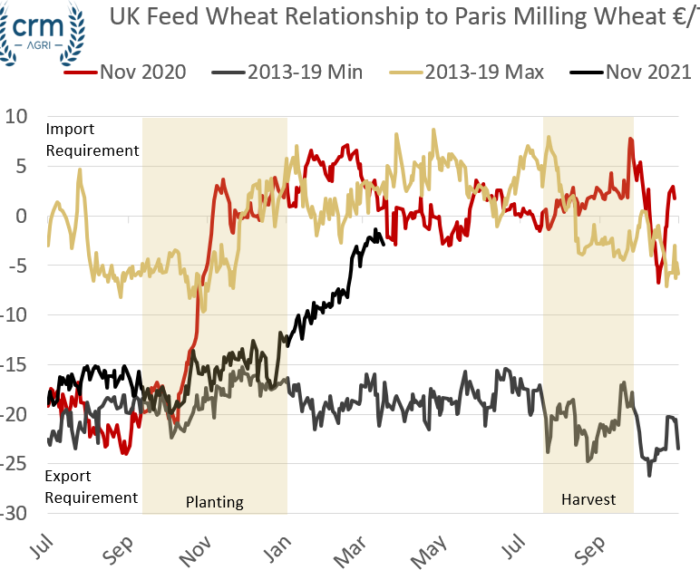

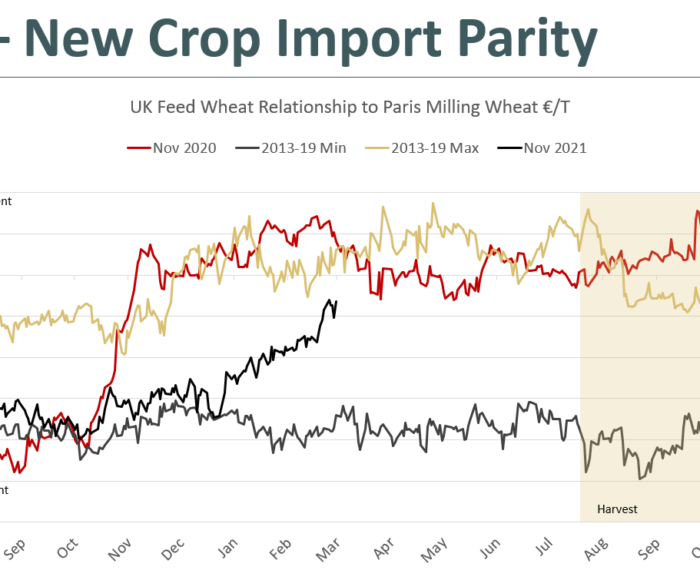

With new crop prices having moved up towards import parity already, global markets will need to climb for the UK to find support. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The latest USDA WASDE changes were limited and mostly reflected known data, and can be viewed as a slightly bearish report.

The big news for oilseed and vegetable oil markets last week was the jump and continued climb of crude oil markets. OPEC+ surprised markets last week by maintaining production minimal levels, being unwilling to increase production amid long-term covid demand outlooks. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Corn markets remain wary of the conditions in Argentina. Very dry and drought like conditions are maintaining production fears for the ongoing…… Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Wheat markets on a global stage have continued to consolidate sideways, with global supply and demand relatively in balance. The concerns for US winter wheat conditions have failed to push markets higher, but we remain cautious Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

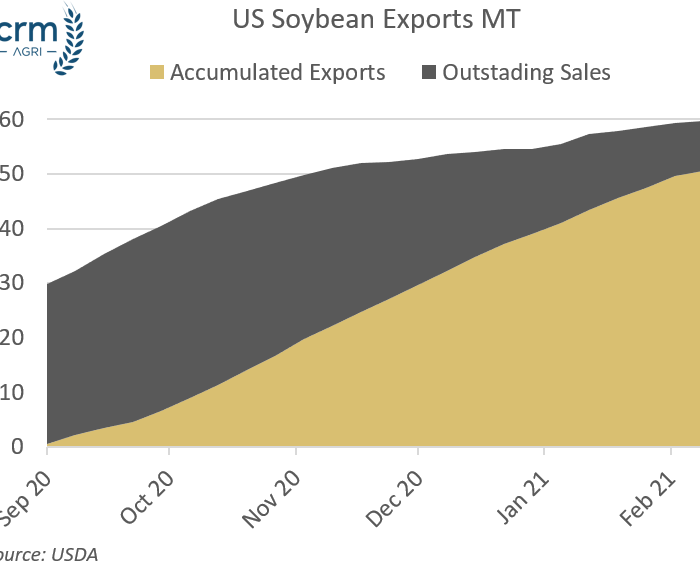

Soy and OSR meal markets are remaining well supported, and from a soymeal perspective, Chicago soy and soymeal markets have been pushed higher as China has been rapidly buying US soybeans and there is a short term squeeze on soybean oil. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO is a monthly round-up and outlook of global markets covering grains and oilseeds. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

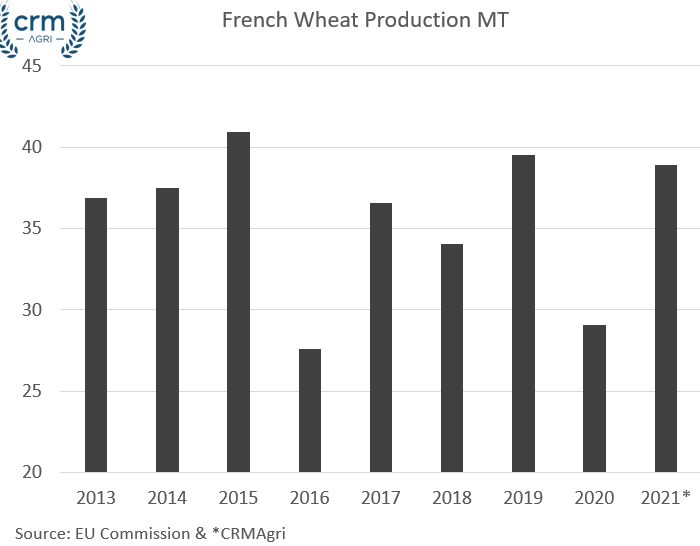

Over the last couple months, we have been highlighting the fine balance between supply and demand for next season and how yields this spring are going to be more critical than ever before. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

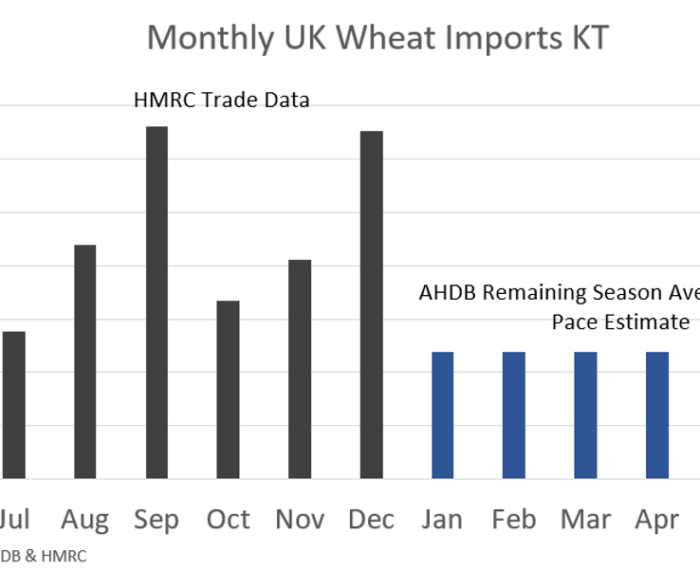

While we broadly agree with the new production figure and the domestic consumption figures, Defra and AHDB seem to still be underestimating imports. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Soy markets have continued to stagnate, having drifted over the last 4 weeks. Similarly to corn, soybeans are in limbo, caught between the diminished US stocks forecast and the imminent record Brazilian harvest. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Corn markets have been consolidating sideways recently, with the upcoming South American harvest balanced by the continued strong demand for US corn by China and the associated reduction in US ending stocks. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe