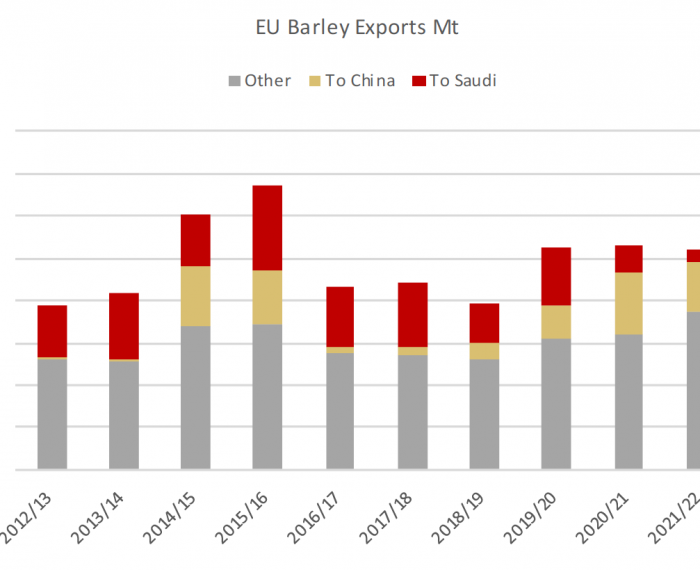

The rapprochement between Australia and China risks adding pressure to Europe’s barley prices, but the impact may not be as severe as it first looks. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

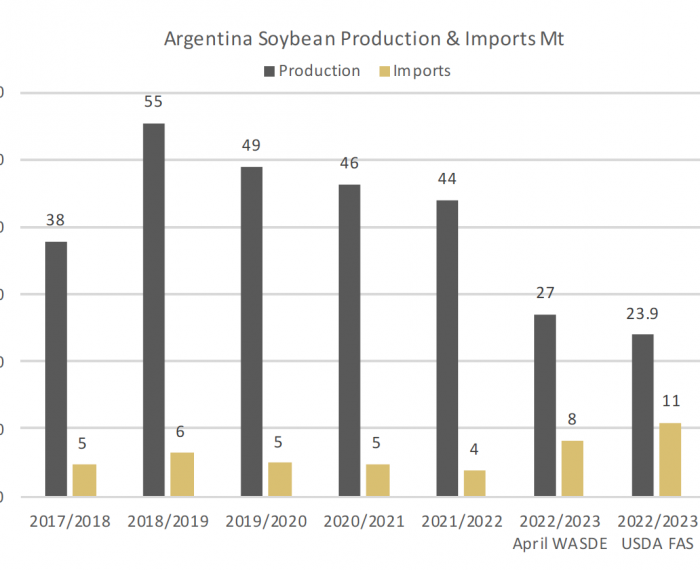

With deeper cuts to production, Argentina will have to import a record 11Mt of soybeans to supply its crushing sector. In recent years Argentina has crushed about 40Mt per year and has a theoretical annual capacity greater than 65Mt, supplying close to half of the EU’s meal import requirement. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

The renewal in mid-March of the Black Sea grain corridor, for just 60 days, is set to expire in just four weeks, bringing the extension of the agreement back into focus. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

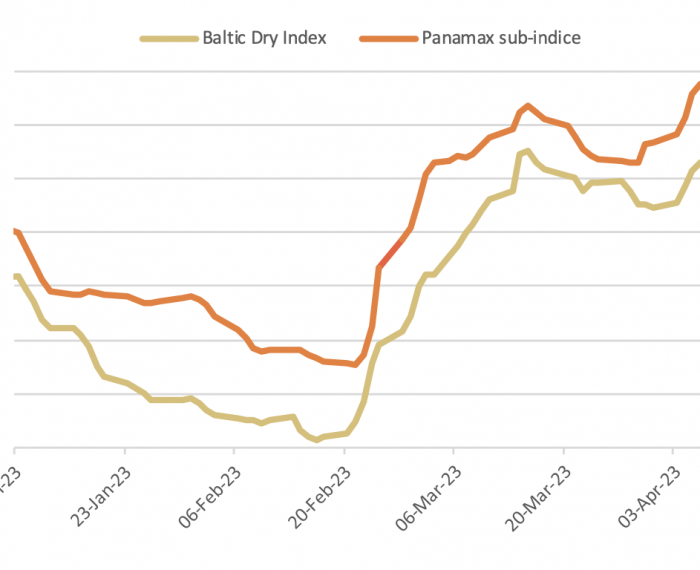

Global supply chain pressures lingered over the past month, with the cost of dry bulk shipping increasing notably. Combined speculative positions in agricultural commodities remain in a net long position, but there remains a large net short position in wheat. Global supply chain pressures lingered over the past month, with the cost of dry bulk shipping increasing notably. Global grain prices will average lower in 2023, but plenty of upside risks remain, particularly due to volatility in energy markets amid still-strong demand. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provide a longer term outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

NDVI scores for Ukraine have also added confidence for new crop harvests, with scores particularly in western areas, where the majority of rapeseed is planted, recording above-average scores. However, while greater confidence in rapeseed production in Ukraine is now entering forecasts for supply in 2023/24, production is still set to contract year on year. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

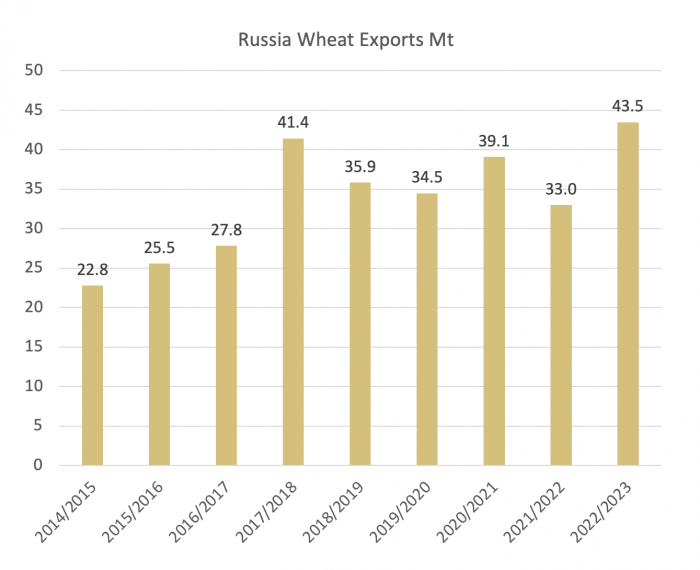

Black Sea grain exports, having made headlines two weeks ago on talk of Moscow putting a price floor on exported wheat, garnered fresh attention when three trading giants announced Russian retreats. Cargill said it was quitting grain elevation, while Louis Dreyfus and Viterra also unveiled exits. Between them, the trio account for about 14% of Russian wheat exports. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Find out about subscriptions Russian Markets Likely To Become Increasingly Opaque

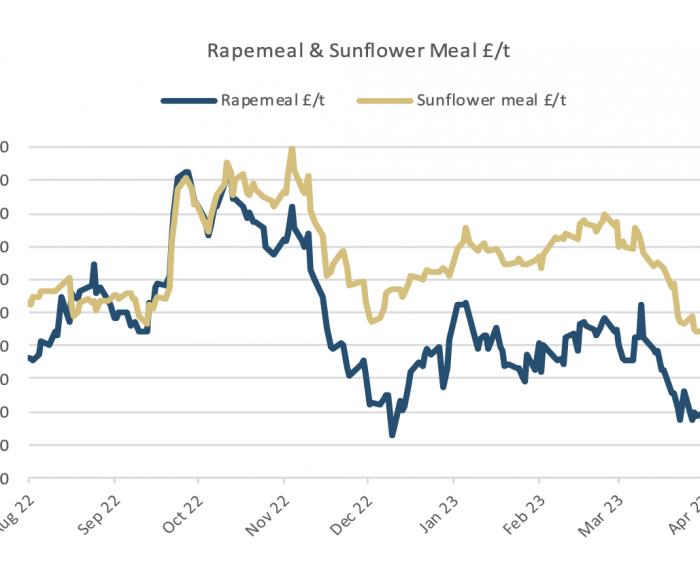

Rapeseed: Rapeseed prices have staged a recovery, after last week falling to their lowest since July 2021.Rapeseed’s price upturn tallied with revivals in many markets, as concerns receded over the bank sector tremors stemming from Silicon Valley Bank’s collapse, and UBS’s takeover of Credit Suisse. Signally, crude oil futures, an important influence on prices of crops such as rapeseed used largely in making biofuels, bounced from their lowest levels since late 2021 as worries over economic fallout faded. Soybeans: Having fallen back down to October lows earlier this month, May-23 US soybean futures have been recording a partial recovery. The bounce in crude oil is providing a floor to oilseed markets, and despite the arrival of the Brazilian soybean harvest, bearish downward pressure is reducing. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

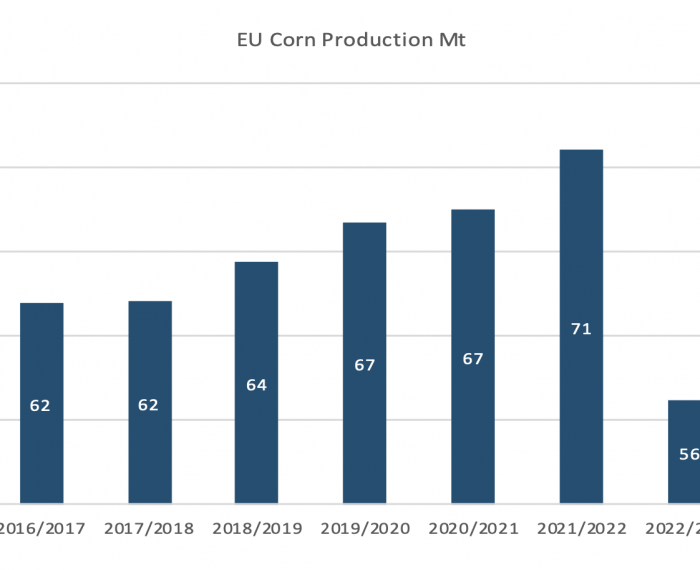

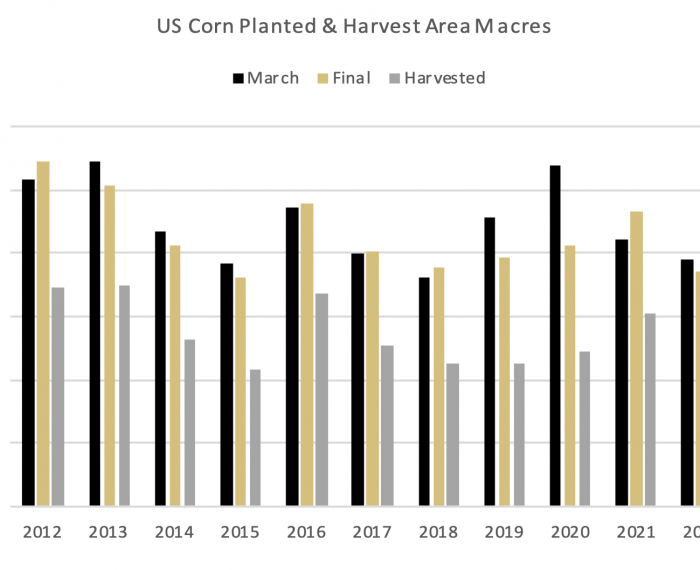

Wheat: Black Sea support has returned as rhetoric surrounding rumoured export bans from Russia, and increased export taxes… Barley: EU barley markets were supported by dwindling supplies of Ukrainian barley… Corn: Corn markets have found support, helping underpin grain markets as China continues to purchase large volumes… Weather: In North America, the Midwest will receive further rains, as farmers prepare for planting… Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Rapeseed: While the pace of EU imports has slowed this month, they remain on course to set a record high above 6.5Mt for the full 2022-23… Soybeans: After what has been a sustained period of support for soybean prices, which remained buoyant while grains came under pressure… Oil & Meal: Vegetable oil values have continued to come under pressure, undermined by the broader economic pressures… Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe