Highlights: • Rapeseed – Prices find support in vegoil market resilience • Soybeans – Chinese import orders, Brazil weather support prices • Crop Watch – Brazil’s planting slowdown Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Key Topics: Corn – Corn hinged on Brazilian supplies Wheat – Wet weather delays Europe’s plantings Crop Condition & Weather – Brazilian risks remain Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Highlights: The World Bank this week, while forecasting an average of $81/Bbl for Brent crude in 2024, said that prices could top $150/Bbl if the Israeli-Hamas war escalates into regional conflict. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Highlights: • Rapeseed – Rapeseed misses lift from buoyant crude oil • Soybeans – ‘Incredible demand’ spurs soymeal rally • Crop Watch – Low river levels curb Brazil’s exports Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Key Topics: • Corn – Ethanol, export demand underpin price revival • Wheat – Argentine, Australian rains vs Russian dryness • Crop Condition & Weather – Low river levels curb Brazil’s exports Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Latest conflict in the Middle East could push crude oil prices above $100/Bbl before the end of the year, boding well for grain markets. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Key Topics: • Corn – Corn prices defy harvest pressure, and fund positioning • Wheat – Winter wheat recovers ground, but spring wheat lags • Crop Condition & Weather – Argentina’s wheat rating declines Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Key Topics: • Corn – Futures outperform by holding firm • Wheat – US market selldown overplayed • Crop Condition & Weather – South American sowing weather Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

• Rapeseed – Canadian prices stabilize, as exports grow • Soybeans – Market braces for big report, and big month • Vegetable oil and meal – Vegoil prices coalesce as sun rises • Crop Watch – Mississippi river level to hit record low? Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

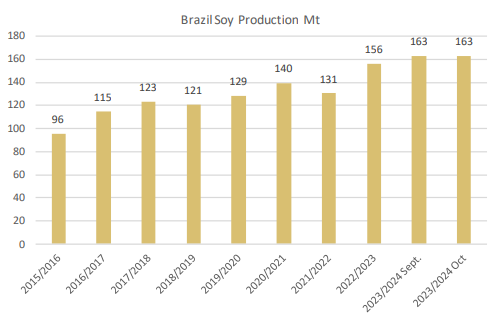

Key Topics: Corn – Brazil’s lowball production estimate Wheat – Argentina, Australia drag market focus south Crop Condition & Weather – US drought snags barge transport Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

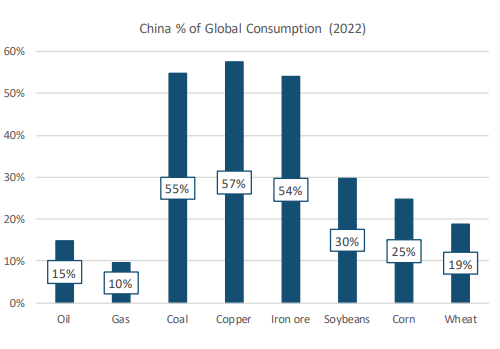

As the world’s largest commodity buyer, China’s economy plays a pivotal role in determining the future direction of agricultural prices. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe