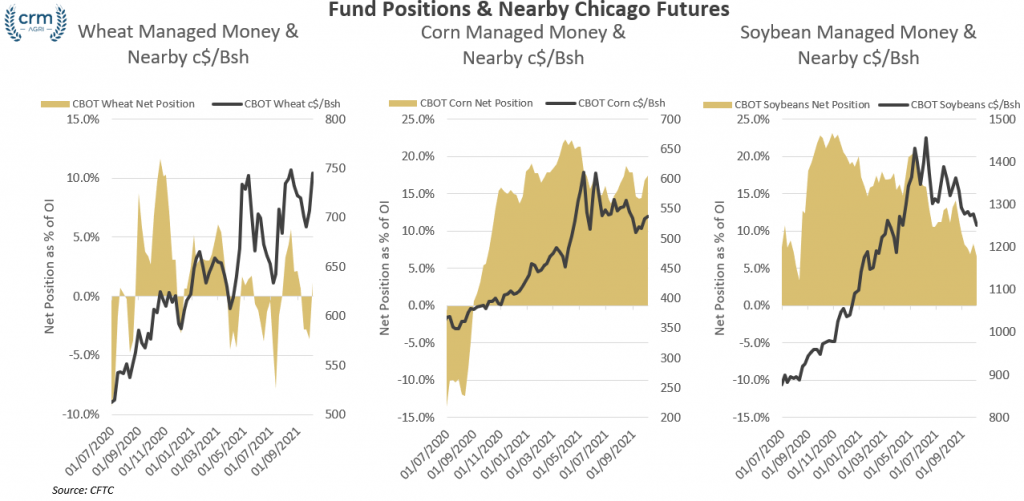

| Ahead of tomorrow’s USDA WASDE markets have been relatively quiet. Last week funds moved to a generally more bullish approach to grains. In wheat, and Managed Money reversed previously bearish tone, increasing long positions to a one-month high. In corn too and the number of long contracts held increased from 268K to 282K long contracts held, the largest number held since the 24th of August. While Managed Money moved to a more bullish position in grains, funds are becoming less bullish toward oilseeds, reducing the number of long contracts held and increasing the number of short contracts held to 34K, the largest number held since August 2020. In the UK, Defra released provisional UK production figures today for wheat and barley. However, we have very little confidence in the accuracy of the data. At 14Mt, the wheat production estimates fall below ours and industry analysis and expectations. For the UK wheat and barley estimates, Defra used a sample of just 1296 farms, but for Wales, there was no data and 2020 figures have been used, the same approach has been used for Northern Ireland, and for Scotland, estimated yields provided from discussions with industry and trade were used not farm data. Find the Defra release here – Production estimates for oilseed rape and other crops will be released on the 14th. |

Categories: Blog