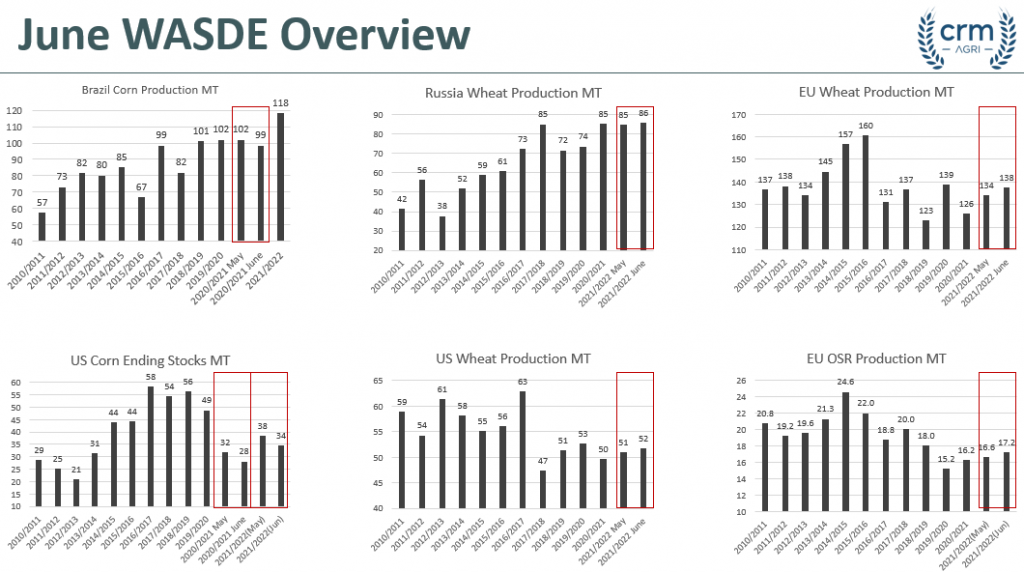

Corn The June WASDE amended the long-overdue cuts needed to Brazilian corn production estimates for the 2020/21 season. Down to 98.5Mt, from 102Mt in May, although revised lower, there are potentially further cuts to come. Changes to US corn production were minimal, but the 2020/21 season end-season stocks were trimmed again, and with a knock-on tightening to the 2021/22 season. 2020/21 end-season stocks revised down from 31.93Mt to 28.12Mt, and 2021/22 end-season stocks revised down from 38.28Mt to a tighter 34.47Mt. Wheat While on paper corn markets tightened, wheat recorded the opposite. The largest surprise being Russian production estimates, revised upwards to 86Mt, up from an already high 85Mt. EU wheat production confidence was increased, with production estimates increased from 134Mt to 137Mt in 2021/22. Upward revisions were also recorded for US wheat, estimated at 51.66MT, up from a previous 50.95Mt. Soybeans Although production estimates were little changed. Of note were larger than previously estimated US soybean stocks. 2020/21 end-season stocks were estimated to be marginally higher at 3.66Mt, up from 3.25Mt in May. The knock-on effect for the 2021/22 season being end-season stocks also revised upward to 4.2Mt from 3.8Mt. A still tight US market but less so. OSR Greater production confidence in the EU and Ukraine have led to increased production estimates. EU production estimates were increased from 16.6Mt to 17.2Mt, while Estimates for Ukraine were marginally increased to 3Mt, up from 2.95Mt. What does this mean? A lot of the changes for the USDA WASDE were anticipated and reflected increasing confidence in European and Black Sea production. Read the Full USDA June WASDE Report Here |