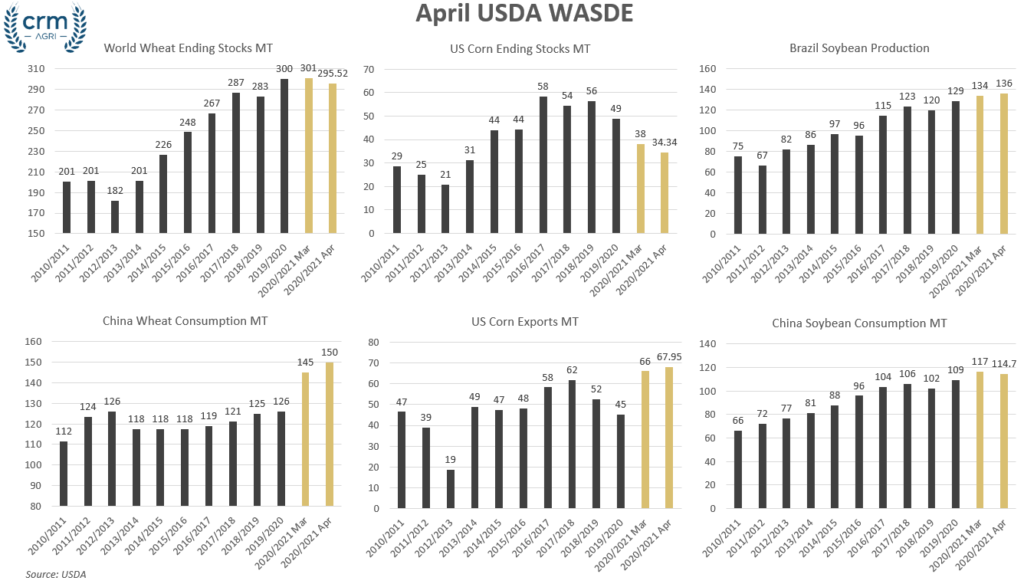

The latest April USDA WASDE was broadly supportive for wheat and corn, with a marginal easing of global soybean supply and demand. However, while the soybean picture is for marginally eased global supplies, this is against a backdrop of minimal US stocks.

Wheat

The largest change to global supply and demand factors is an increase to Chinese wheat consumption, up to 150MT, from a previously elevated 145MT. With the increase in Chinese demand, there are drawdowns for the global wheat ending stocks, again driven by the increased Chinese demand. Outside of China, global supply and demand was relatively unchanged, the notable exception are marginally increased US stocks, up from 22.76MT to 23.18MT.

Corn

The major changes to the corn global supply and demand estimates were focused on the US, with the recent uptick in US corn demand. US corn domestic consumption estimates are increased to 307.35MT, up from the previous 305.45MT, partly due to increased ethanol demand. Combined with increased export figures, up to 67.95MT from 66.04MT, and US ending stocks have been reduced, down nearly 4MT.

Soybeans

Global soybean markets had some bearish news in the recent WASDE, but this is against a backdrop of tight US stocks.

The major changes were to Brazilian production, up to a record 136MT, from a previous 134MT. Chinese demand is seen as weakening, with consumption estimates down 2MT to 114.7MT and ending stocks are estimated to be up 2MT to 31.6MT, an early sign of second wave African Swine Fever demand destruction?