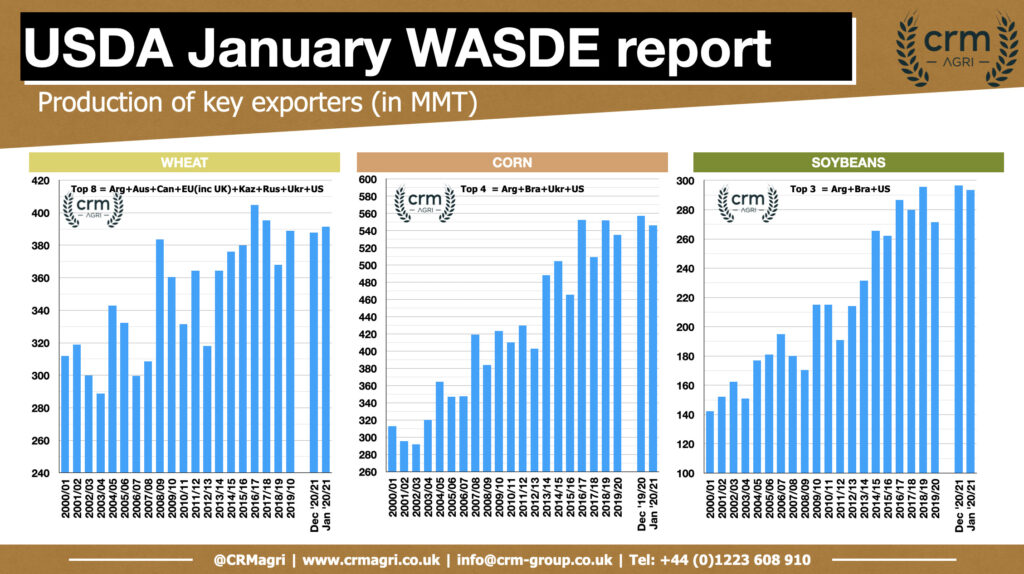

The start of 2021 has continued to fuel the grain and oilseed rally in price. Markets are fully focused on the tight supply as we move through Q1 and toward the South American harvest. Supplies in the US are the tightest in multiple years following a record pace of export sales, making yields in south America critical in a year of La Nina conditions.

Wheat

Entering 2021, and wheat markets are relatively well supplied on a global level but have been supported by corn. However, with politics interfering in grain markets, the rational supply and demand factors have been outweighed recently by Russian threats of export limits. Overall, from a wheat perspective in the January WASDE, there were limited new bullish factors, Russian production was increased yet again to 85.3MT, up from the previous 84MT estimate, however due to export tax implications, exports were lowered to 39MT, building ending stock projections with a potential bearish start to 2021/22 Russian wheat supplies.

Argentine wheat production estimates were decreased to 17.5MT, which shouldn’t have been a shock to markets with multiple South American based organisations having been estimating production close to 17-17.5MT for quite some time.

Overall, wheat supply and demand factors are lacking in themselves for a bullish market, but don’t underestimate the ability of politics to get in the way of rational supply and demand. Wheat will continue to be led by the corn market, fully focused on South America.

Corn

The USDA surprised markets with a shock reduction to US corn production estimates, downgraded further in the January to 360.25MT from 368.49MT in the December USDA WASDE. This reduction to US supplies further tightens the US balance sheet, placing even greater importance on South American production.

With so much focus on South America in a La Nina year, there were expected modest downward cuts to Argentinean corn production from 49MT to 47.5MT, but offset due to increased beginning stock estimates, raised to 4.37MT, up from 2.87MT previously. Brazilian production estimates also received modest cuts to production estimates, down 1MT to 109MT but leaving export and consumption estimates untouched.

Tightening the US outlook from a demand view has been unexpectedly large Chinese demand for corn imports. The January WASDE increased their import estimates by a modest 1MT to 17.5MT, although it remains unclear why and where this additional demand is to be sourced from.

Overall, bar the US, the global corn picture is little changed, bar small deceases to South American production and expected slightly increased imports for China. What provided a shock to markets was the unexpectedly large cuts to US production estimates, providing an overall supportive USDA WASDE for Chicago corn, with greater focus on South America over the coming months.

Soybeans

The January USDA WASDE for oilseeds proved to be less surprising than for corn, but with such a tight Q1 of 2021 following exceptionally fast US sales, even small bullish news is enough to provide support.

US Soybean production was marginally reduced to 112.55MT, down from 113.5MT, which combined with an increase to export estimates reduces soybean ending stocks further.

Cuts have been made to production estimates for Argentina, down to 48MT, down from the previous 50MT. No cuts or changes were made to estimates for Brazil, or Paraguay.

Chinese estimates for imports have been left unchanged, but following an increase in production estimates, Chinese ending stocks are estimated at 28.6MT, giving room for reducing or slowing imports.

With further pressure on US ending stocks, the outlook for South American supply will now be of greater focus.