Weekly Oilseed Outlook

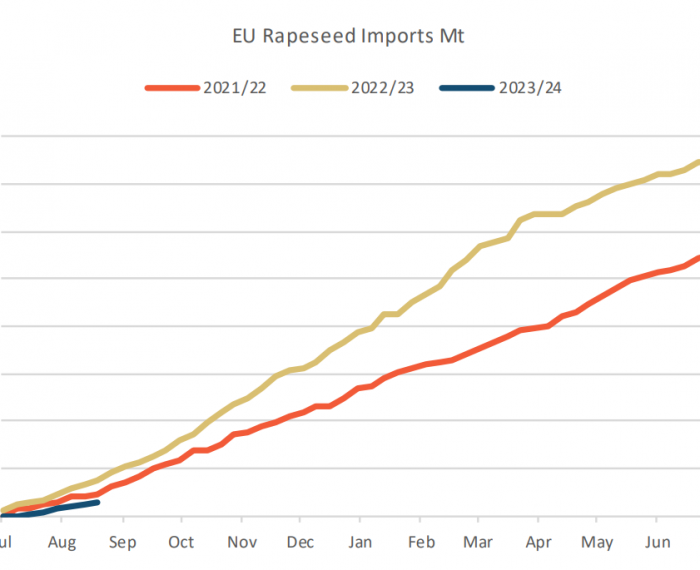

EU rapeseed imports set to improve. • Rapeseed – Market declines invitations for volatility • Soybeans – After-tour rally runs into demand resistance • Vegetable oil and meal – EU crushers turn to rapeseed, soy • Crop Watch – Australia and El Nino Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Grain Outlook

Corn futures have, since earlier in August hitting their lowest since 2020, found support once more as weather forecasts deteriorate and conditions appear worse than expected. Corn – US Midwest faces further heat Wheat – Canadian harvest hopes recede Crop Condition & Weather – Australia and El Nino Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Oilseed Outlook

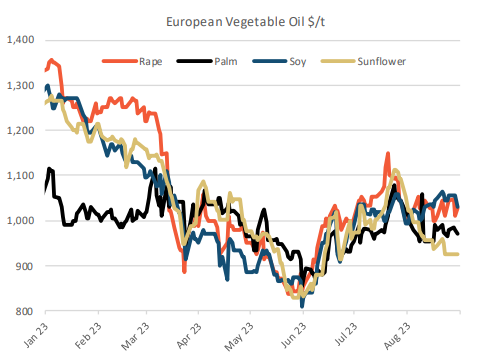

That rapeseed prices are resisting seasonal pressure from the northern hemisphere harvest reflects in part external factors, such as the recovery in crude oil markets Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Grain Outlook

Temperatures over the weekend approached 100 Fahrenheit (38 Celsius) in Iowa, the top corn-growing states and second-ranked soybean producer, and topped 100 Fahrenheit (43C) in parts of the southern Plains… Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

August Global Grain Outlook

GGO provides a longer term, opinion based outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Agricultural Economic Outlook – Climate Change Special

Climate change poses a risk to more volatile yields, while also driving demand for biofuels, providing long term support for global grain prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

August Wasde Review & Weekly Market Highlights

USDA Wasde Review & Weekly Highlights Overview Volatility in the…

Weekly Oilseed Outlook

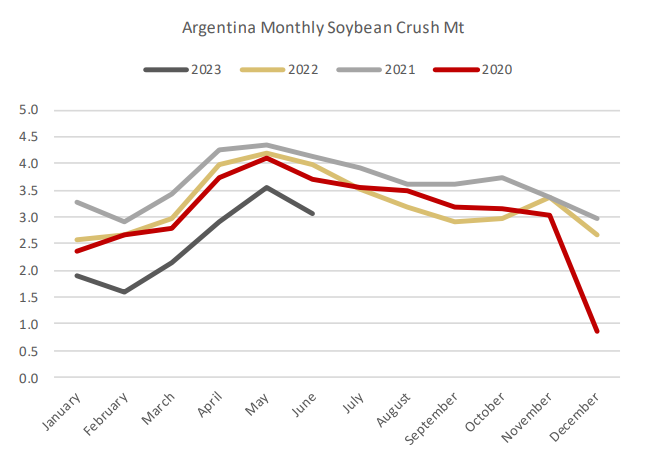

Argentina’s soybean crush shrank by 23% year on year in the first half of 2023. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Grain Outlook

The Black Sea tensions are particularly influential on prices of wheat, of which Russia and Ukraine are both big exporters (see below). However, the two countries are a force in corn too, expected by the USDA to originate a combined 24Mt of shipments in 2023/24, 12% of world corn exports. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Oilseed Outlook

El Nino-inspired dryness will curtail South East Asia’s palm oil output, has placed extra emphasis on production dynamics. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe