Weekly Oilseed Outlook

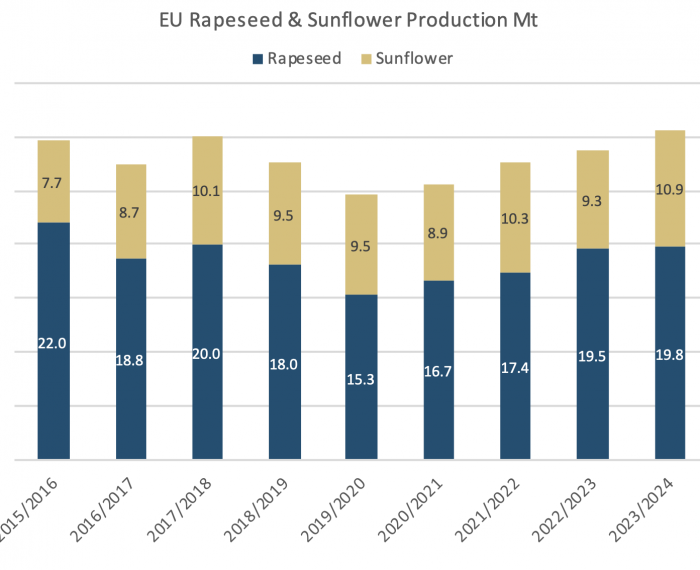

The planted area for sunflowers is due to see a 10% increase above 5-year average and reach 4.8Mha, on account of the temporary derogation from the obligation to allocate a part of the arable land to non-productive areas and a possible switch from corn in drought affected regions. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Grain Outlook

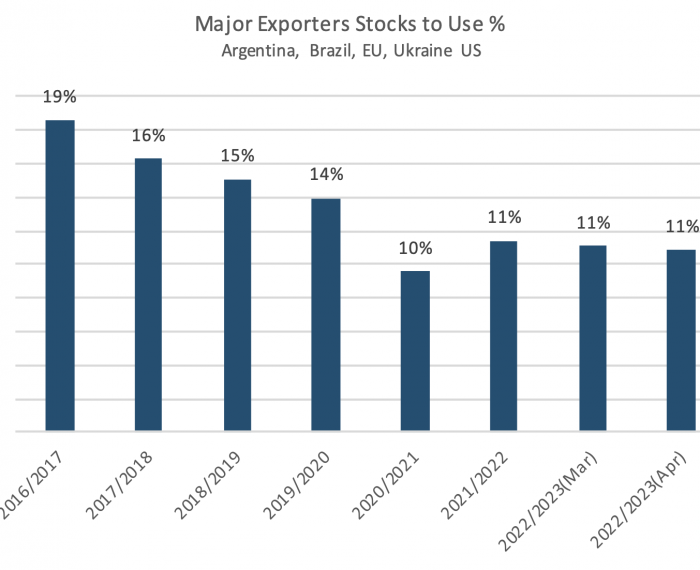

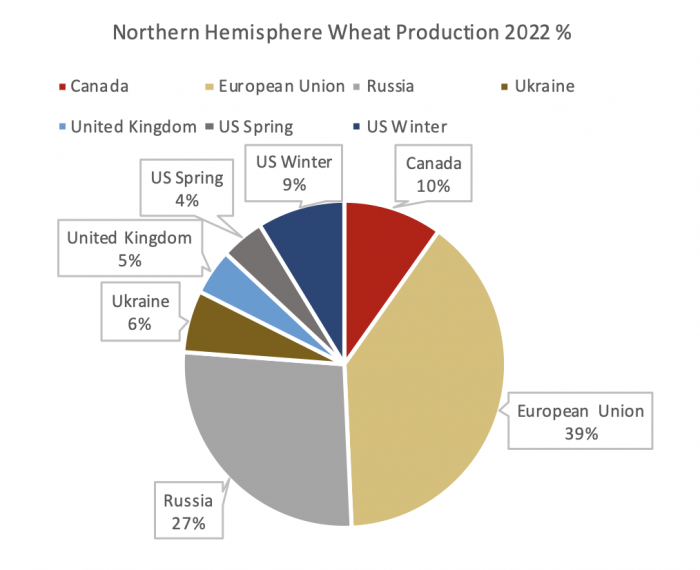

Grain markets have sagged, as discourse surrounding Ukraine’s exports subsided and wet southern Plains forecasts eroded concerns for the US hard red winter wheat crop. However, factors remain in place which could yet provoke price recovery and for now, prices remain underpinned by tight exporter stocks and new crop uncertainty. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

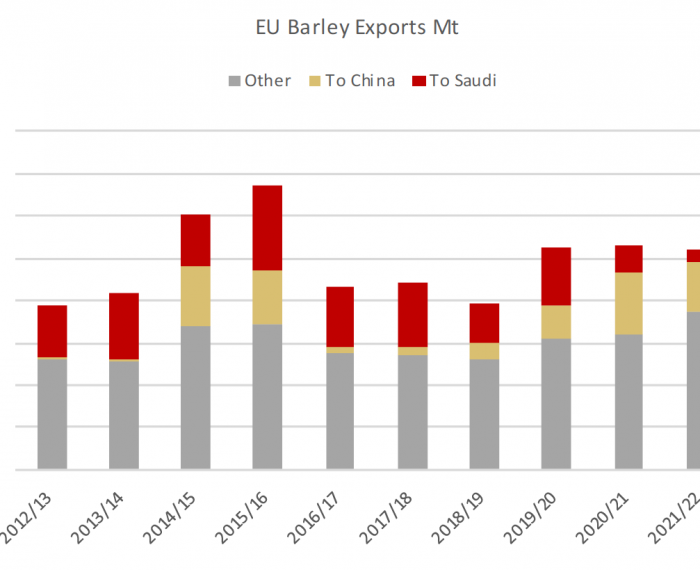

Highlight Analysis: What China’s return to Australian barley would mean for the EU

The rapprochement between Australia and China risks adding pressure to Europe’s barley prices, but the impact may not be as severe as it first looks. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Oilseed Outlook

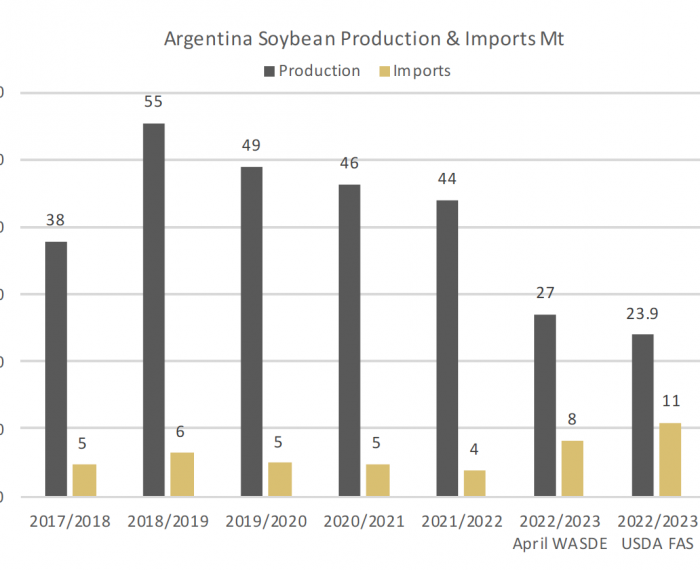

With deeper cuts to production, Argentina will have to import a record 11Mt of soybeans to supply its crushing sector. In recent years Argentina has crushed about 40Mt per year and has a theoretical annual capacity greater than 65Mt, supplying close to half of the EU’s meal import requirement. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Grain Outlook

The renewal in mid-March of the Black Sea grain corridor, for just 60 days, is set to expire in just four weeks, bringing the extension of the agreement back into focus. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Global Agricultural Economic Outlook – April 2023

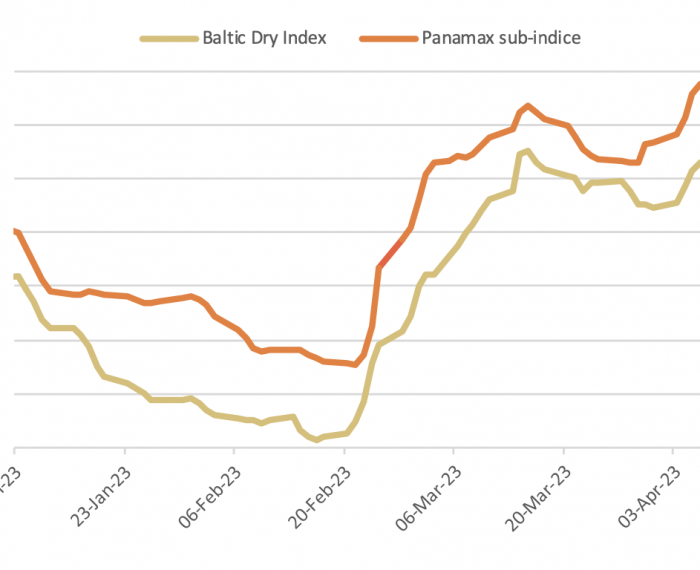

Global supply chain pressures lingered over the past month, with the cost of dry bulk shipping increasing notably. Combined speculative positions in agricultural commodities remain in a net long position, but there remains a large net short position in wheat. Global supply chain pressures lingered over the past month, with the cost of dry bulk shipping increasing notably. Global grain prices will average lower in 2023, but plenty of upside risks remain, particularly due to volatility in energy markets amid still-strong demand. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

April Global Grain Outlook

GGO provide a longer term outlook for grains and oilseeds markets, complimenting our regular insights, S&D and price forecasts -Grain Price Forecasts (US, EU, UK) -Grain and Oilseeds Analysis -Global Balance Sheets -Prices Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

USDA April WASDE Analysis

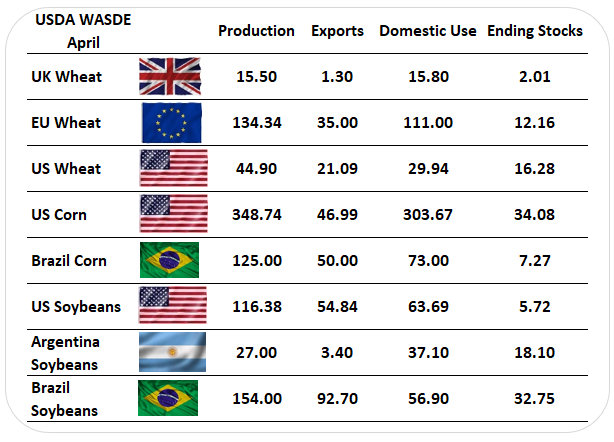

USDA Wasde Overview Wheat: In the April WASDE, US wheat supplies eased with ending stocks increasing from 15.47Mt to 16.28Mt as US domestic demand estimates…

Weekly Oilseed Outlook

NDVI scores for Ukraine have also added confidence for new crop harvests, with scores particularly in western areas, where the majority of rapeseed is planted, recording above-average scores. However, while greater confidence in rapeseed production in Ukraine is now entering forecasts for supply in 2023/24, production is still set to contract year on year. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe

Weekly Grain Outlook

Black Sea grain exports, having made headlines two weeks ago on talk of Moscow putting a price floor on exported wheat, garnered fresh attention when three trading giants announced Russian retreats. Cargill said it was quitting grain elevation, while Louis Dreyfus and Viterra also unveiled exits. Between them, the trio account for about 14% of Russian wheat exports. Access all of CRM AgriCommodities’ independent analysis and insights with a subscription. Get research, data and opinions from our team of analysts and advisors to help you make better informed decisions with a unique perspective on markets. If you are already a member and require login details, please get in touch. Log In Subscribe