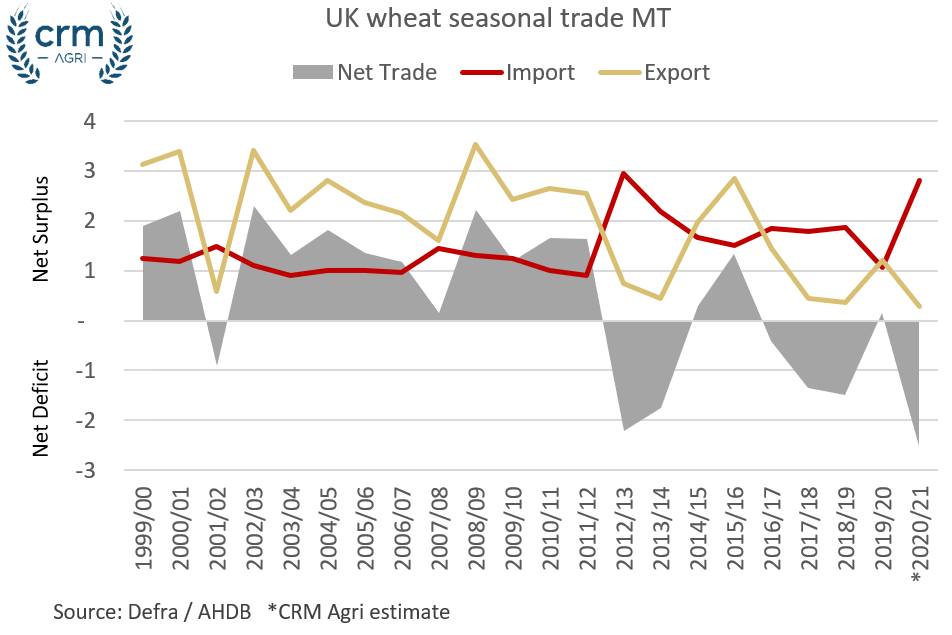

With the recent years of smaller wheat crops, the standard assumption that domestic wheat will need to be export competitive has been lost. Swinging between to net export and import over the last few seasons, the pricing relationship that the UK has had with the world has become more volatile as explained in our latest weekly wheat focus.

Looking to next season (read monthly. outlook forecasts), and following what has certainly been another abnormally wet winter, albeit with autumn drilling off to a better pace, the planted area is expected to bounce back by between 25-30% year on year. However, at close to 1750Kha, this will require above-average yields to produce any kind of meaningful exportable surplus.

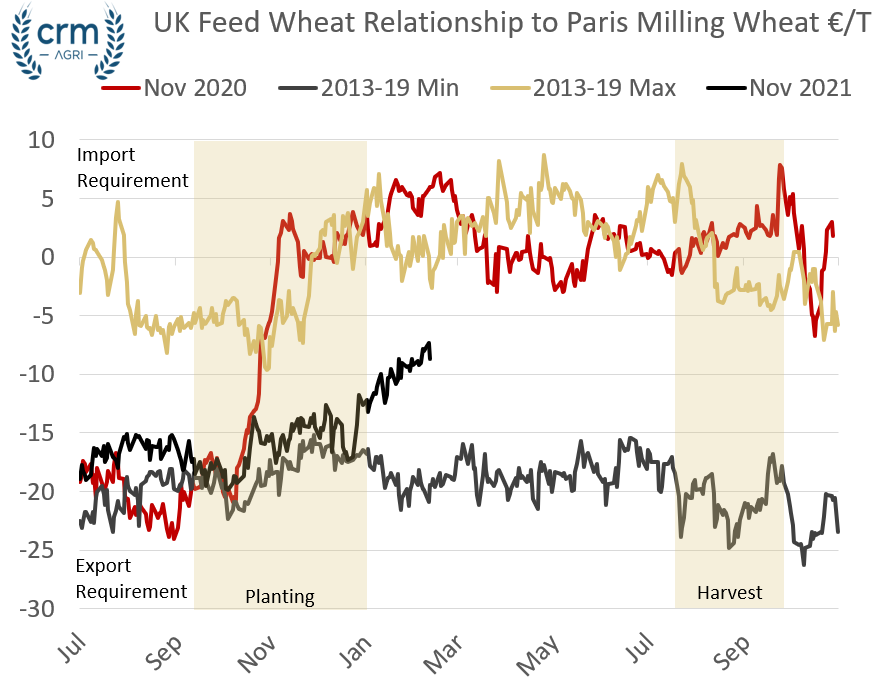

With the UK supply and demand picture for next year firmly at the mercy of spring and early summer weather, new crop Nov-21 feed wheat futures are pricing in this uncertainty and have been climbing relative to December-21 Paris milling wheat.

A full overview of the UK market structure relative to global markets and managing these risks is covered in the ‘UK Markets’ module of our Grain Academy (Members receive 25% discount – get in touch).

Looking out at now melted and waterlogged fields, markets are losing confidence in the prospects for above-average yields and an exportable surplus next season. At now close to €10/T below new crop Paris milling wheat, the UK is in financial ‘no-mans land’, neither pricing high enough to allow imports next season, nor low enough to gain export competitiveness.

Although it is too early to have much confidence in yield projections, the chance of having exceptional national yields this harvest is probably off the table. Conditions in the spring are going to be more critical this year for the pricing relationship for next years crop.

To learn more about the UK domestic market and the reasons behind trade flow pricing, sign up for our UK Domestic Market online course. https://grainacademy.talentlms.com/catalog